How green is the beauty industry?

Can beauty brands balance consumer demand for eco-friendly products with their profit margins?

Welcome to Climate Drift – where we explain climate solutions and help you find your place in the fight against Climate Change.

Not subscribed yet?

Hey there 👋

Skander here.

As we move into 2025, one question is becoming increasingly impossible to ignore: Which industry is really becoming more sustainable?

Our 160-slide Climate Recap 2024 explores climate change's impact, major narratives like the role of China in Climate Tech and AI's energy footprint, and the trends, roadblocks, and opportunities shaping 2025.

Check it out here:

Today Maura is taking a very deep look into the beauty industry. With growing consumer demand for eco-friendly options and brands scrambling to stay ahead, it's not just about packaging—it's about reshaping the entire system and products.

But is the industry really ready for change? From the challenges with recycling systems to the complexities of carbon neutrality, we’ll break down what’s working, what’s not, and what needs to change.

Let’s not ignore waste and pollution, why the current recycling systems aren’t cutting it, and how brands can adapt to meet the growing demand for sustainable options.

Last but not least, we are looking at the problem as consumers: How can we navigate the sea of green claims and make informed choices?

🌊 Let’s dive in

The 4th cohort of our accelerator is starting mid February and applications are still open (and a few spots are left). We are already interviewing and selecting participants, so apply now and make an impact:

🚀 Apply today: Be part of the solution

But first, who is Maura?

Maura White is a seasoned marketing and communications professional with over a decade of experience across sectors like technology, media, health, and wellness. She’s worked with Fortune 500 companies, such as Samsung and Microsoft, as well as supporting marketing for startups like Polyvore and IndieGoGo. Her recent work includes branding and growth strategies for health equity and community impact nonprofits. Now, Maura’s focus is on climate-related topics, including technology, policy, and equity, blending her expertise with her passion for sustainability.

How green is the beauty industry?

(Click the title 👆 to read the full deep dive online, it’s a long one)

Summary

The beauty industry is undergoing a transformation as sustainability and circularity take center stage. Consumers and brands alike are exploring new avenues to minimize environmental impact, from routes of consumption and recyclable packaging to refillable products. This report explores the intersections of conscious consumerism, producer responsibility, and the beauty industry's evolving practices toward a greener future whilst avoiding greenwashing and false claims.

Taking Accountability of My Personal Beauty Consumption

In the middle of 2024, I was struck by how many beauty products I had amassed. While nowhere near the over hyped consumption that had been dominating social media, parts of my skincare routine felt cumbersome to navigate. Moveover, I learned that waste management in my region did not support pick-up processing and I had been “wish cycling,” placing empty containers in the recycling bin with the wish rather than the knowledge that they would end up in the right place.

I took stock, accounting for just over 200 products across home, bags, and personal vehicle. Now, three months later and amidst Project Pan trending, it’s an ideal moment to share how participants can reduce setting upon the world the waste they’ve accumulated.

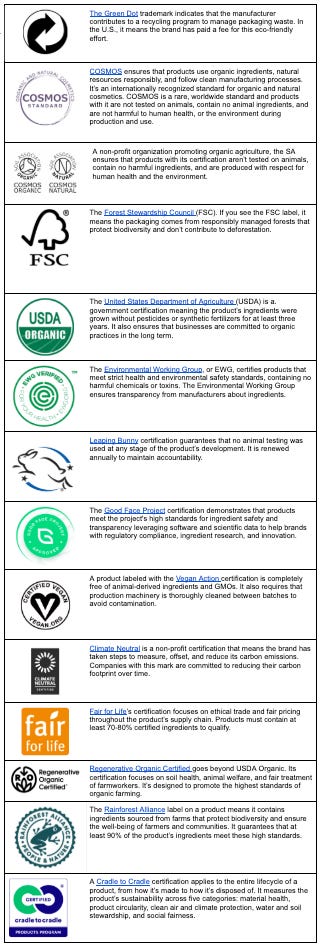

Existing data tells us that 31% of digital buyers in the United States spent between $1-50 per month on beauty products in 2023 with 27% reporting that they spent more at $51-100 per month. Among all of my products are a dervish of labels, claims, ingredients, and form factors – some whisper that are made of post-consumer recycled plastic or cardboard, other little plastic tubs lay slovenly without any claims and carry little product. Others tout approvals from Leaping Bunny, B-Lab, or Organic FDA, focusing on what is happening earlier in a product’s linear lifecycle.

Understanding and navigating the beauty industry’s claims requires vigilance. Most claims are unique, linking to data around a product’s ingredients, material feedstock and composition. Some are tied to development processes, trade agreements, animal testing, and use of regenerative agriculture. Others are linked to sustainability investments and carbon emissions. Is it reasonable to expect a consumer to make conscious purchasing decisions in this somewhat inharmonious symphony? And will most realize or care to take the time to dispose of their products properly.

The Short Answer

When your beauty and skincare products are all used up, traditional recycling won’t accept, properly sort, or recycle those empty containers. But here’s what you can do! Pact Collective bins support the collection of hard-to-recycle beauty packaging that would likely end up in the landfill. Pact bins support the collection of hard-to-recycle beauty packaging that would likely end up in the landfill. Check out its website and follow instructions on how to prep your products for disposal after so many months of service. Collect the containers and take them to your nearest Ulta or Sephora and ask where they keep their Pact Collective bins. You can find the nearest location online. If the nearest location is too far, there are options to mail in your empties. Be sure to check out its collection guidelines on what types of packaging is accepted at the Pact bin as you may be as surprised by the variety of products they accept as I was.

Desperately Seeking Sustainability

Increasingly people are prioritizing sustainability because they understand that there are limits to our planet’s resources and want to do what’s within their power to help. Sixty-seven percent of global beauty shoppers actively seek eco-friendly products, and nearly 70% of those under 35 are willing to pay more for them. Over a third of Gen Z adults would even pay a 10% premium for eco-conscious beauty items. Ulta’s ESG report echoes this trend, with 86% of shoppers—especially Gen Z and younger Millennials—expressing interest in sustainable beauty.

Some organizations and supply chains are actively responding to and accommodating growing demand. Between 2017 and 2023, David Luttenberger, Global Packaging Director at Mintel, said that refill offerings in Germany, U.K., U.S., and France have increased by as much as 279%. For instance, The Perfume Shop and L'Oréal launched a multi-brand fragrance refill station in U.K. stores saving both the brands and customers money. Driven by consumers seeking a better value proposition for their product choices over time, refillables offer brands the chance to seek out and identify marketable product attributes beyond the percentage of recycled content or materiality presented in current packaging options.

Refillables are an emerging, but leading eco-friendly alternative. APC Packaging produces an EcoReady Refillable Airless Jar (ERAJ), designed to preserve the viscosity of products with refillable inner cups. For its design, it won a Green Award at Luxe Pack in New York last year. Bosk BioProducts/Regen makes a bioplastic jar that’s 100% plastic free, using a proprietary PHA bio-resin derived from industrial carbon sources, such as pulp and paper sludges.

On the packaging processing end, Eastman opened a molecular recycling facility in Tennessee designed to recycle plastics into feedstock for new products, and is partnering with Pact Collective to certify its molecular based recycling technology to produce materials with the same quality, clarity, and durability as virgin materials.

New re-use and refill concepts are a chance to forge new relationships between brands and consumers who are looking to alter their consumption habits and improve their experience. Companies that establish stronger planet-friendly manufacturing practices will be able to increase consumer loyalty by opting for circular packaging that competitors do not provide.

How Large is Beauty’s Contribution to Waste?

The ugly truth is that the beauty industry is a significant contributor to waste, climate change, and water use. In 2020, the industry used 10.4 million tons of water. It is also considered one of the largest contributors to ocean pollution and wastewater. It creates a high demand for natural oils, leading to broad-reaching and intensive agriculture practices with pesticides and fertilizers. This harms natural habitats through deforestation and contaminates soil and water. The social side of the beauty industry is no less scary. Mica, a natural silicate mineral dust, found in many cosmetic products to brighten and add shine, has come under fire for extensive and undisclosed child labor in mines within India, Madagascar, China, Brazil, Sri Lanka, Pakistan, South Africa. and Malaysia.

Plastic packaging waste from the beauty industry produces 120 billion units annually. Plastic is a popular choice for beauty products because it is the most hygienic option. But the rise of Korean beauty, BeautyTok, and Millennials entering their 40s are compounding the global cosmetic industry’s growth and it’s expected to hit $560.5 billion by 2030 – bringing increased environmental consequences. Ninety-five percent of cosmetic packaging is thrown away with 79% landing in landfills or as pollution, and 8 million tons entering oceans annually.

Rethinking Consumption in Terms of Circularity

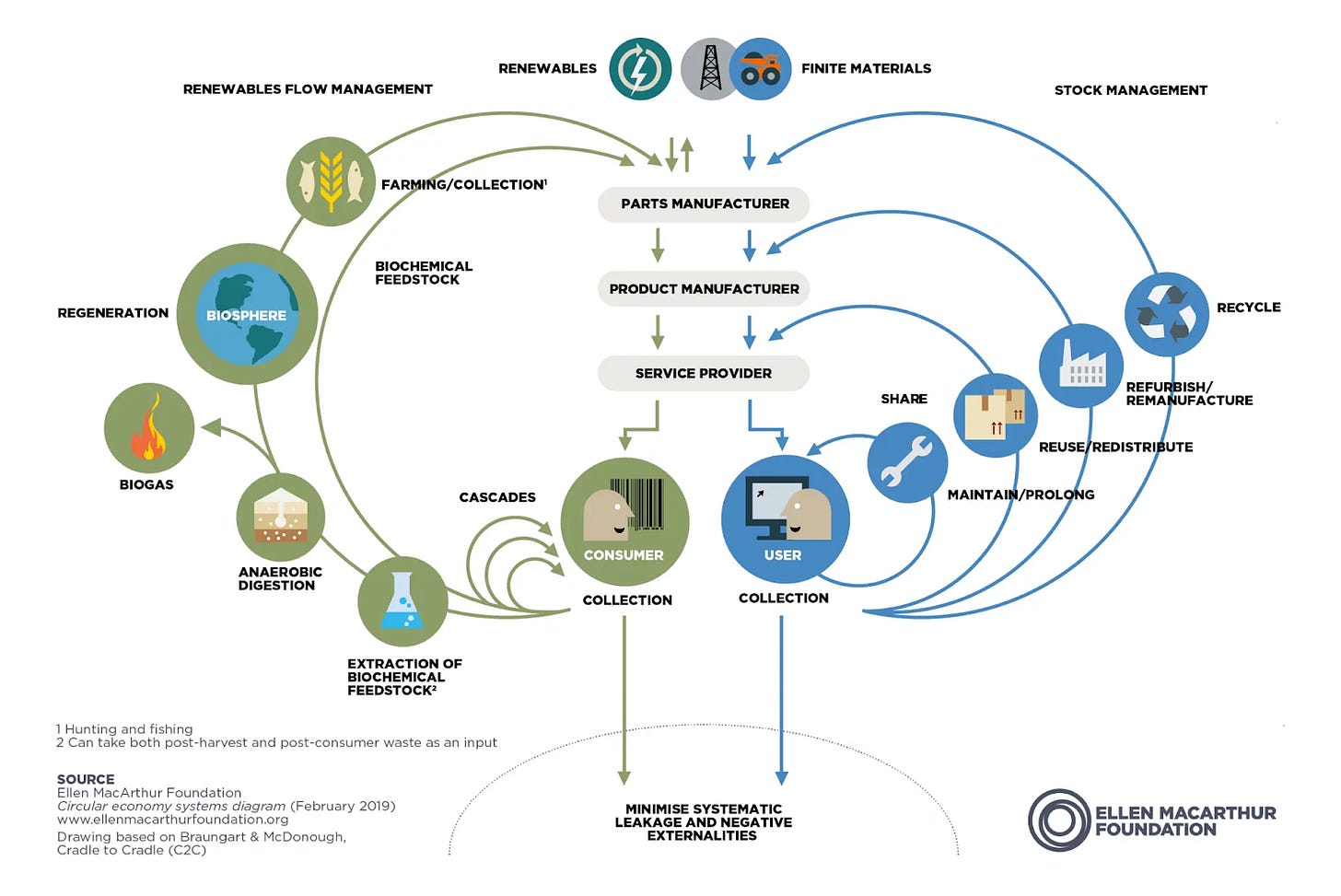

Beauty packaging poses sustainability challenges due to its reliance on mixed materials, complicating recycling and efforts to shift to a circular economy. The circular economy is a means to minimize waste as much as possible through sharing, reusing, repairing, recycling, or upcycling existing objects or materials to extend the life cycle of materials, creating longer-term value chains for said materials. It is a systemic approach to economic development designed to benefit businesses, society, and the environment. In contrast to the ‘take-make-waste’ linear model, a circular economy is regenerative by design and aims to gradually decouple growth from the consumption of finite resources.

The fast-paced evolution of consumption is accelerating the degradation of our planet. Fast fashion is a familiar concept, but fast beauty is just as damaging. The reality is that recycling and municipal waste management systems are not collecting, separating, and processing materials at the required scale. Beauty products are often considered too hard to clean, expensive to process, and time consuming to make it economically viable. As a result, it ends up in the trash.

Why are Current Recycling Systems Ostensibly Failing?

Imagine breaking an egg and then trying to cleanly separate all of its parts. No easy feat! Mixed materials are no different. They aren’t easily separated and recycled without costly human intervention. Mixed materials or multi-layered packaging is extremely difficult to process because the capabilities to do so are not commonly in place and our systems cannot economically support the various amounts, form-factors, and colors of plastics produced without costly human intervention at the point of processing. For example, at a materials recovery facility (MRF) in Washington state, equipment has to be stopped for 15 minutes every two hours so that machinery can be cleaned from contamination of non-recycled items. This presents issues for worker safety and adds cost: over $1 million annually for a single facility.

“Insufficient U.S. recycling infrastructure is a challenge in accelerating circularity for cosmetic packaging. [Many] people lack access to recycling and our current recycling systems do not support small-format and flexibles, even if designed for recyclability” said Marissa McGowan, Chief Sustainability Officer, North America, L’Oreal group.

“For the consumer who wants to understand why they can't put their beauty empties in a collection bin, [it’s important] to keep it as concise as possible and then give consumers the option to learn more,” said Tara Fothergill, Membership and Brand Director, Pact Collective. “That translates into how MRFs should be communicating on curbside recycled programs. The most successful MRF programs are heavily visual.”

Another challenge for waste management involves bridging recycling gaps for small form factors, as seen across the beauty industry. Currently, the PET recycling rate in the U.S. is at about 30%. In comparison, South Korea is a leader at 58% – which means 70-90% of PET plastic in the U.S. is not being recycled. This lack of effectiveness erodes public trust in a system which desperately needs several forms of intervention.

How can Recycling Systems be Improved?

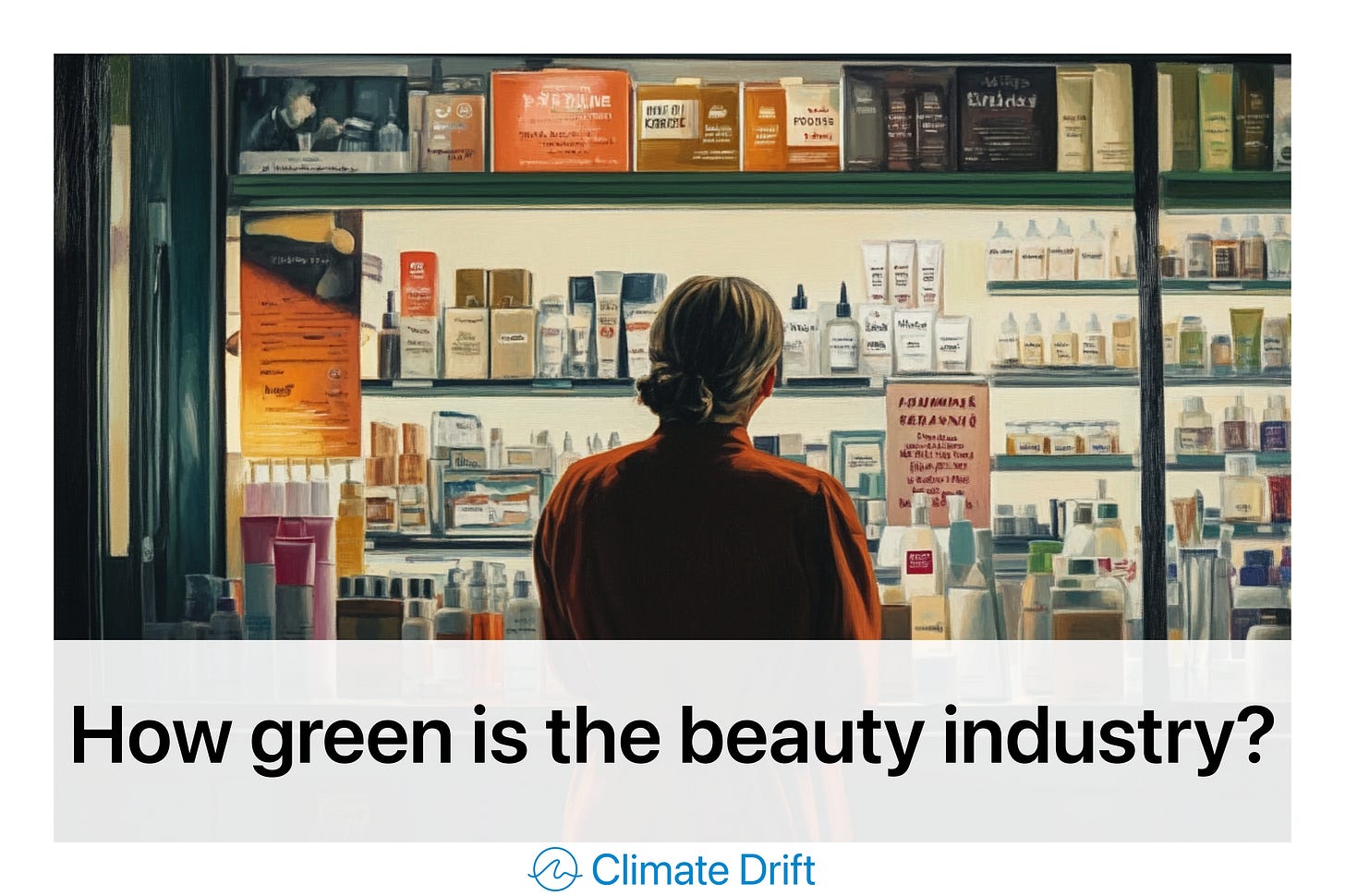

One form of recycling intervention is in Extended Producer Responsibility (EPR) policies. EPR is an environmental policy that makes companies, or producers, responsible for the entire lifecycle of their products. This includes design, take-back, recycling, and final disposal. EPR legislation takes aim at the entire lifecycle of a product, and requires producers to register with their respective government to finance the collection, recycling, and recovery of waste, as well as report upon the quantities and types of materials they place and recover from the market.

Currently, EPR legislation exists in the European Union (EU), India, Australia, Japan, Canada, and the United States. Even though EPR exists globally, its legislative requirements are different country by country, and also between regions, states, and provinces with varying tariffs and fee structures to schedules and reporting requirements. Within the U.S., nine states introduced EPR legislation for packaging in 2024, and five states currently have packaging bills that have passed into law. Some national laws have also been introduced, though many have stalled in the legislative process.

Fee-based EPR policies are instrumental to improving our waste management system. With EPR, funding is dedicated to the after-use management of packaging with clearly defined targets. But there are challenges to overcome with EPR policies that include a producer’s lack of knowledge when it comes to all the data in their manufacturing and supply chain; the preparing reports for each operating piece of policy across various geographies; and tracking changes to EPR legislation at a global scale.

Beauty is one of the most complicated and difficult sectors to regulate with EPR due to the industry’s use of small format, mixed materials, and need for source reduction. Pact Collective is diving into EPR heavily in the near future by working with lawmakers who draft EPR legislation and the Circular Action Alliance. It is advocating for its member brands to provide resin codes to support transparency on packaging and is in the process of working with one of its founders, Credo Beauty, to provide a webinar and additional guidance, such as toolkits and FAQs, to its members in support of EPR legislation rolling out in various states, such as California’s SB343 law.

“We make recommendations to our members on design guides for labeling, packaging, and we’ve leaned in to recommending QR codes over actual directive right on the packaging so that brands can change those recommendations as either EPR legislation rolls out or as widely acceptable [waste management] changes are made in curbside programs,” said Fothergill.

Pact Collective’s goal is to support brands of various sizes, especially smaller brands that often cannot afford a compliance team, to translate and navigate EPR legislation into viable action. It is also working with the Independent Beauty Association on EPR guidance to avoid duplication and foster a pre-competitive approach. One avenue it’s exploring for future deployment is a dedicated tool to support brands with default information on EPR legislation to assist smaller brands in reaching compliance standards. This tool would leverage AI technology that is pulling in comparable information for HAZMAT compliance standards. It would give brands the ability to load product information automatically or manually, where they are selling their product, and their revenue to determine whether a product is compliant or not, the qualifications around its need to pay for producer responsibility. The tool would effectively create a logic branch roadmap across various regulatory jurisdictions from packaging perspective so brands can understand the steps necessary to reach compliance.

Why Are There Economic Disparities in the Recycling Sector?

Simply put, the process of collecting, sorting, and recycling costs more than the revenues made from selling recycled materials. This creates a deficit in how investment arms view the economic viability of the recycling sector’s solutions. Non-funded, market-driven recycling is only made possible with informal waste-pickers collecting and sorting packaging in return for a low-income in precarious working conditions. It’s estimated it would require $30 billion a year to cover the net cost of scaling and operating improved collection, management, and recycling of plastic alone, and to cover all materials currently used in manufacturing would cost exponentially more.

Being unprofitable is a huge barrier to mobilize the investments needed to meet the demand of our collective recycling needs, and to rapidly scale them further to meet the growing scope of materials humans create. Investments would need to evolve over time to meet or ideally exceed materials processing operating costs.

Improving the technology and education necessary to sort packaging in recycling centers is underway in some regions. Ohio-based MRF, Rumpke Recycling recently invested $100 million to improve its processing capabilities and now operates at the speed of 60 tons per hour, achieving 250,000 tons of material a year. It is working with its equipment supplier, Machinex, to add ballistic separators, trommels, artificial intelligence capabilities, and other equipment to achieve the goal of a 98% capture rate. Leveraging ballistic separators and optical sorters to perform 2D/3D sorting gives Rumpke a competitive advantage over traditional MRFs that often use rotating disc screens. Ballistic separators are multifunctional machines that allow the treatment of various types of waste. These machines are capable of dividing a material stream into three fractions – heavier 3D fractions such as tins or stones, lighter 2D or flat fractions such as paper and film, and small-sized fractions which are screened down. Ballistic separators and opticals aren’t plagued by the tangling, maintenance, and wear issues experienced by older star screens used for materials sorting.

Under progressive EPR legislation, funding is established to support a continuous investment in waste management, and sourced from manufacturers who are responsible for any material’s creation through to end-of-life. Ideally, EPR funding is leveraged to support higher education programs that support research and innovation on incorporating circular economy solutions to our waste management systems. In addition to its MRF, Rumpke invested $200,000 to establish a research and development (R&D) center in collaboration with Ohio State University for students and faculty to work on-site and undertake research and development, engineering, sustainability, and green economy projects to advance waste sorting technologies.

EPR is gaining political momentum bolstered by the long-standing support of international organizations, community-based organizations, and non-governmental organizations. But to be truly successful, EPR must operate in a broader circular economy that incentivizes organizations to engage in the procurement of recycled content. Whether this is via tax reductions or rebates, or disincentives for non-circular outcomes, such as for using virgin materials or a tax for ending up in a landfill. The AI in the TiTech optical sorters used by Rumpke identifies items by evaluating their shape, size, color and other visual characteristics, allowing the optical sorter to differentiate between different PET and HDPE form factors. This level of sorting also allows Rumpke to produce plastic that goes back into feedstock for reuse using chemical processes that are emerging and capable of breaking plastics down to molecular puzzle pieces, so they can be reconstructed into new forms.

This is not to undersell the value of our current recycling systems. According to the EPA’s current data, each individual in the U.S. generates 4.4 pounds of trash per person, per day. Eighty-seven million tons of materials are recycled or composted, preventing the release of 186 million metric tons of carbon dioxide into the atmosphere - comparable to taking 39 million cars off the road for a year. Despite 80% of the population in the U.S. having access to curbside recycling, recycling participation has stalled at 34% since 2010. This means more education and access is needed for consumers when it comes to recycling. In fact, two-thirds of Americans believe that recycling is a very or extremely important issue, citing benefits for the economy, public health, environment, and waste reduction.

Reimagining the Feedstock for Materials

Packaging machinery, manufacturing processes, and innovative material developments are emerging in the sector. Integrating these enables the beauty industry to move away from plastics and other unsustainable materials that are flooding the waste management system and our environment.

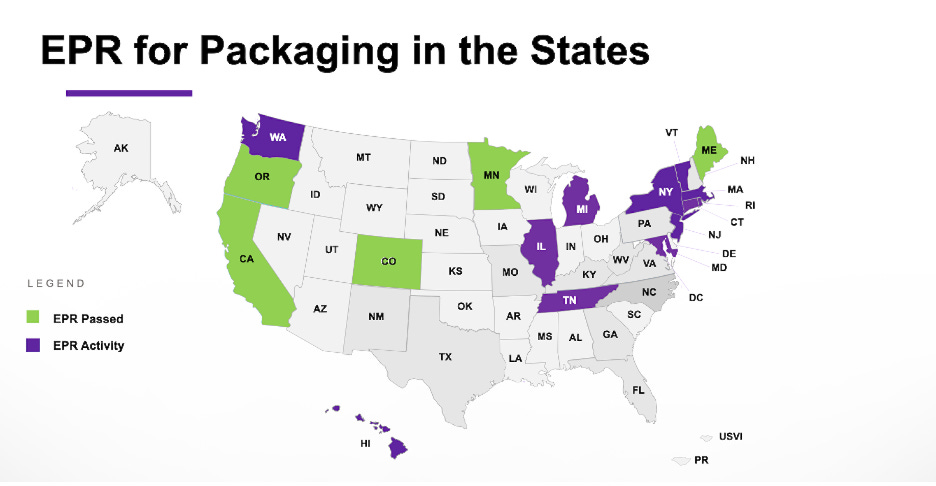

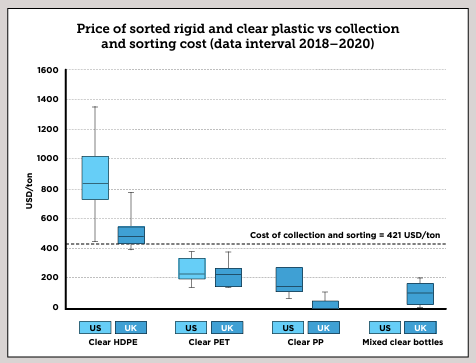

The cost of managing plastic waste from now until 2040 will be $70 billion greater than if the world adopted a fully circular approach. Beauty packaging uses an array of plastics, including PE, PP, PS, and PET. HDPE and PET are the most commonly used plastics in the creation of Post-Consumer Recycled plastic (PCR). With recycled polyethylene terephthalate (rPET or recycled PET), there is an advantage of a smaller carbon footprint with an overall 71-79% reduction in GHGs versus virgin plastics.

The cost to use rPET is higher because it is in lower supply. Though there is a growing demand for recycled materials, many companies struggle to find a steady source of high-quality PCR. To address this challenge, brands and packaging manufacturers have to bake in the sourcing of PCR back into feedstocks by supporting the development of waste management systems that can feed that same demand. Accomplishing this requires investments into PCR feedstocks to be viewed as long-term partnership versus a singular transaction. Organizations such as the Association of Plastics Recyclers and Circular.co offer networks of collectors, recyclers, manufacturers, guidance, and best practices to support the success of plastics recycling.

Many of the current sources for PCR involve workers who are working in low-paid and hazardous conditions. Often these workers are women and children. In Brazil, it’s estimated 200-800K workers contribute to the recycling trade, working long hours impounded by poor living conditions, prejudice, and harassment.

In developing countries where plastic-waste is often imported, waste-picking data is not recorded or monitored in the greater context of the recycling economy. This creates significant gaps in the system, including the lack of transparency when it comes to the source of PCR, lack of collection and treatment of non-recyclable, low-value plastic, and a lack of human rights and fair working conditions for the informal waste sector. Brands must acknowledge the fundamental rights of workers in developing nations who are picking up the tab when it comes to the labor required in managing appropriate waste disposal and sourcing PCR.

Alternative materials made from mycelium (mushroom proteins), agri-waste (such as wheat and sugar cane bagasse), and molded pulp are supporting new, creative packaging solutions. For instance, Ecovative Design is creating an alternative to beauty blenders that is made of MycoFlex, a 100% pure mycelium product, that can also be used for items like footwear and luggage. The NY-based company has also developed mycelium packaging that biodegrades completely in just over one month.

Sulapac has created a range of sustainable packaging and functional materials to cater specifically to the cosmetics industry. This packaging contains a low carbon footprint, no microplastics, and no evidence of a toxic load left behind.

Traceless, is a group of biomaterial engineers who use plant waste from the agricultural industry, such as starch, to create novel biomaterials that are regenerative by design. Unlike some bioplastics, Traceless uses a patent-pending process to extract natural polymers in order to create complete-plastic free materials in a granulate form called ‘natural biomaterials’ that are able to degrade within a home composting system in 2-9 weeks! Traceless is also partnering with Mondi to develop a coating solution to replace thin, outer plastic packaging.

Companies that uphold the value of life cycle assessments for their products while prioritizing ethical sourcing can help reduce their impact on pollution, contribute to the advancement of the waste management system overall, and improve human rights and labor standards for people who are managing the end of life for materials that are ultimately the responsibility of the producers.

Adapting Circularity to Consumer Behavior

In China, approximately 3 billion empty cosmetic bottles were produced in 2021, and 70% was incinerated or landfilled as general waste. In response, several makeup and personal care brands — such as L'Oréal, Procter & Gamble, Coty, L'Occitane, Shu Uemura, and Herborist — initiated recycling schemes in China for empty packaging with cosmetic brand Yan An Tang (YAT). YAT secured funding aimed to minimize this waste and increase recycling rates by offering a one-stop solution where consumers can send their mixed packaging waste. The skincare brand ran a pilot with 448 Watsons stores — one of Asia’s biggest health and beauty retailers — to test in-store recycling models with an online platform called “Diary Recycle" which worked as a mini-app within WeChat.

YAT handled the sorting, cleaning, disassembly, crushing, and granulating of the empty cosmetic bottles, producing PCR content that could be incorporated back into new products. As of February 2024, YAT has 280,000 registered users, and has received more than 230,000 empty bottle orders. Estimating an average of three bottles per order, the business has recycled nearly 750,000 cosmetic containers.

In the U.S. and Canada, Pact Collective has designed a framework that supports monitoring verification and reporting of environmental claims. Buttressed by a membership of 150+ beauty and wellness brands, retailers, and packaging suppliers, it offers brands and consumers an avenue to participate in its brand agnostic recycling program, with over 2,800 collection bins across the U.S. and Canada, including at Ulta and Sephora. As previously noted, Pact Collective also offers in-office, mail back, and bin sponsorship collection methods.

Pact Collective supports a brand-agnostic recycling model, meaning a brand does not necessarily have to be a member of the collective to have its products properly collected, sorted, or recycled. Once collected, post-consumer products are distributed across a recycling hierarchy. This hierarchy starts at upcycled materials and moves down the ladder to downcycled materials, molecular recycling, and waste-to-energy at the lowest level of post-consumer materials processing. Its collection programs have diverted an estimated 239,807 pounds of beauty packaging from landfills. It’s also working to ensure that PET waste can be qualified as feedstock for future use.

How Can Brands Achieve Carbon Neutrality?

Consumer preferences and the limitations of our planet’s resources have propelled beauty brands to set environmental goals that include a shift away from single-use and virgin plastics, providing recyclable, reusable, and refillable packaging while offering greater transparency around source ingredients. To achieve a carbon neutral certification, a beauty brand must engage with an external, specialist consultancy to help target and measure its carbon footprint and devise ways to reduce, offset and manage its carbon emissions to reach 'net zero'. This type of certification is offered by various bodies, including Carbon Trust and Carbon Neutral.

Carbon offsets are growing under increased fire for their use as a band-aid on the bigger issue of reducing and eventually bringing greenhouse gas (GHG) emissions to zero. The Voluntary Carbon Market (VCM) is an effective, transitional tool for organizations interested in investing into offsets when they’re unable to make significant changes in their own operations.

Through carbon offsets an organization or brand can make a financial commitment to a cleaner future by investing in an earth positive project or program. This can be a wind farm, protecting a forest, or installing electric vehicle charging stations. While this does not erase the emissions created by the organization, it essentially offsets the GHG emissions, and the certification holds the brand accountable to reduce its release of GHGs in the future. For instance, skincare brand OSEA Malibu invested $16,128.76 in carbon offsets in 2021 to balance out 4,032 metric tons of carbon emissions as part of its Carbon Neutral certification.

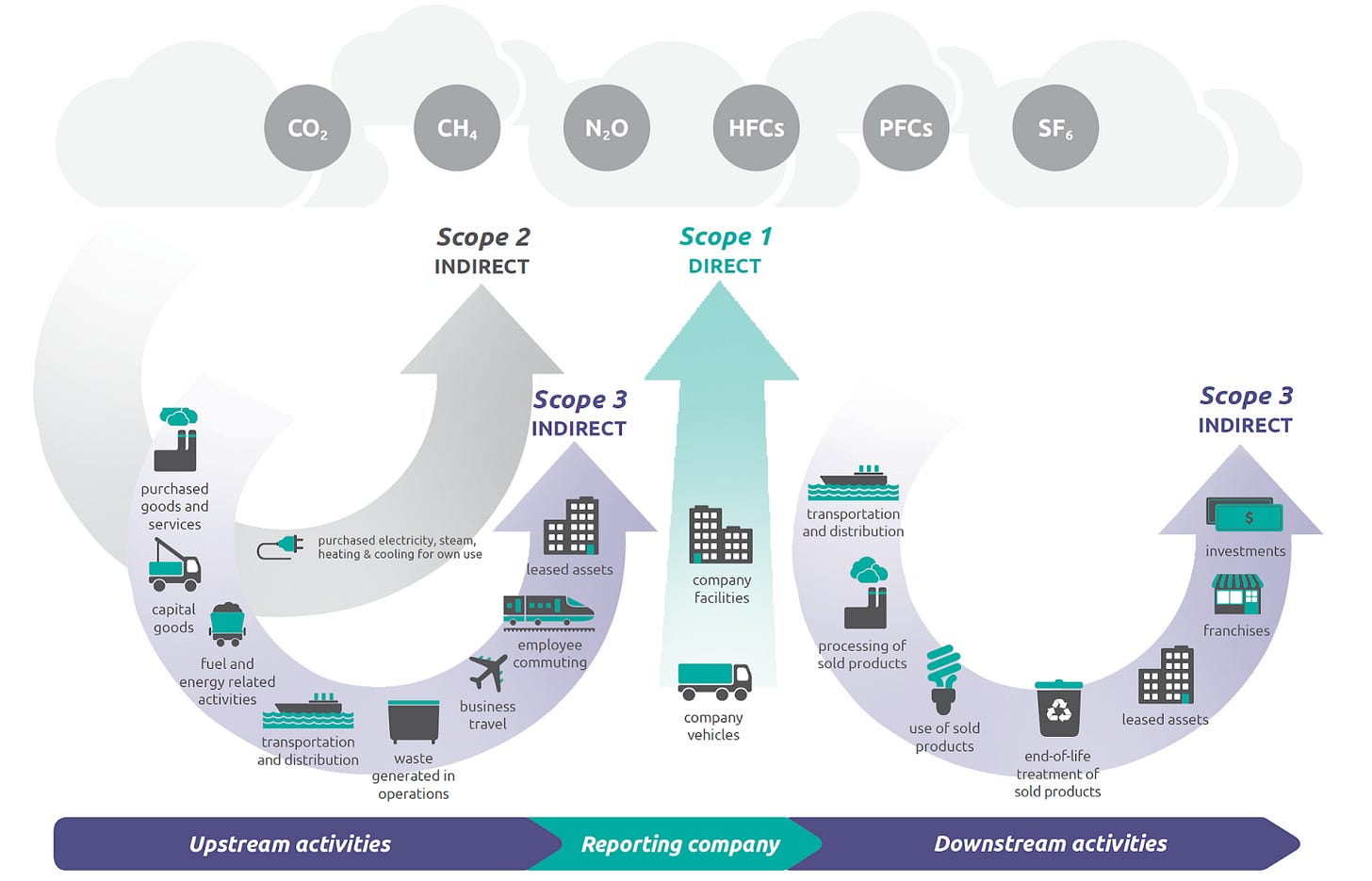

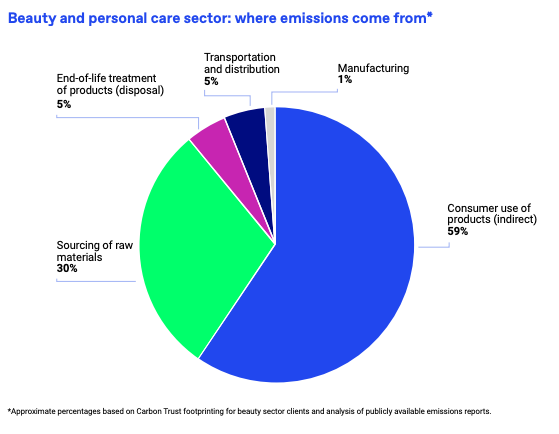

It’s important to note the differences between scope 1, 2, and 3 emissions. A portion of emissions for beauty providers fall under scope 3, which includes the packaging from a supplier or electricity to power machinery. Emissions from scopes 1-3 are used to tabulate a carbon footprint and provide insight into carbon neutrality. Some brands struggle to find scope 2 and 3 partners that can address their supply needs or that hold credible carbon neutral partnerships. According to Carbon Trust, the sourcing of raw materials by the beauty industry is responsible for 30-50% of the sector’s emissions with 40-80% of total sector emissions from scope 3 activities.

Because of the complexity in relaying to consumers the differences between being carbon neutral to scope 1 to scope 3 emissions, brands have to provide greater transparency about their neutrality, responding to queries regarding their practices, and remove the burden off of the consumer when it comes to education.

How Can Consumers and Brands Use Claims and Certifications to Build Trust?

Certifications and claims on packaging ultimately aim to build consumer trust. By providing third-party verification and an independent assessment of a product’s sustainability or ethical claims, brands can reduce the risk of greenwashing and make it easier for consumers to identify products that align with their values. However, obtaining certifications is complex and expensive, especially for smaller brands.

Navigating claims and certifications as a consumer can be equally challenging, especially when each certification holds different meaning, value, and impact. This is when broad terms like “clean”, “environmentally friendly”, or “green” create opacity around a product's true impact. What may be vegan and not tested on animals, may not be sustainable when it comes to how it was created or what happens to the packaging once it's discarded.

“Unless you can substantiate a claim, you should be removing it.” said Fothergill.

In the United States the Federal Trade Commission’s Green Guides specify the kinds of green claims a company can make and can only occur if marketers’ claims are “truthful and substantiated.” The 2024 Green Guides contain new sections on: 1) certifications and seals of approval; 2) carbon offsets, 3) free-of claims, 4) non-toxic claims, 5) made with renewable energy claims, and 6) made with renewable materials claims. In California, lawmakers enacted SB343, to prohibit the use of Mobius arrows or any other indicator of recyclability on products or packaging unless specific criteria are met and enacted a characterization study of material types that are collected, sold, sorted or transported within regional solid waste facilities.

In addition, the passage of the Modernization of Cosmetics Regulation Act (MoCRA) in 2022, gave the FDA more authority to crack down on the safety of how cosmetics and personal care products are produced, marketed, and tested. Similar laws to those from the FTC and FDA exist in the European Union, Canada, Australia, and Japan where truthfulness is required in claims about environmental friendliness.

Often the onus is placed on consumers to be vigilant with their purchase decisions, even though 78% of beauty consumers think it’s the responsibility of companies to protect the environment.

Here is a sample of commonly found and recognizable beauty certifications in the United States:

Can Consumers Trust Retailer Certifications?

Unfortunately, the answer is a maybe. Retailers that closely track consumer behavior have taken note of how sustainability and environmental impact drive purchase decisions. Many have created their own set of standards to help guide and accelerate consumers toward a sale, though in the process they’ve created another layer of labeling to decipher.

Ulta Beauty has been working to highlight clean beauty products with dedicated sections and signage. In 2020, it launched its “Conscious Beauty” program, which certifies products under five pillars: clean ingredients, cruelty free, vegan, sustainable packaging and positive impact. To qualify for sustainable packaging, at least 50% of a brand’s total packaging, by weight, must be recyclable, refillable or made from recycled or bio-sourced materials. Over 300 brands at the retailer are certified to one or more pillars, according to the retailer’s site, though the degree to which each brand is compliant and under which particular pillar is not as easy to identify.

In 2021, Sephora launched its “Clean + Planet Positive” labeling, for which a product must meet all five requirements: sustainable sourcing, climate commitment, responsible packaging, environmental giving, and clean ingredients. Each pillar has its own set of requirements. Specifically for the climate commitment pillar, a brand must meet at least one of the three following climate goals: carbon-neutral operations, greenhouse gas emissions reduction, or have a corporate office that is owned or leased operations powered by 100% renewable energy. Under its environmental giving pillar, a brand must donate at least 1% of its profit to a high-impact, long-giving program that is multiyear and ongoing, or be a Certified B-corporation.

Whole Foods has also developed a set of baseline body care standards in quality sourcing and environmental impact in order for products to earn its Premium Body Care logo. To date, Whole Foods has identified more than 400 ingredients deemed unacceptable to carry in-store or online.

SmarterX recently completed an assessment comparing the badging criteria of different clean beauty programs and examined how many products meet the criteria but aren't labeled. For Sephora, it found that out of 390 products marked as clean, 54% contained some type of fragrance, and 22% contained Phenoxyethanol, which must be 1% or less of the total formula. Despite Sephora's guidelines, many products lacked detailed breakdowns of these ingredients, leading to potential compliance issues. For Ulta, SmarterX found that of the 7,500 products analyzed, 7.67% could qualify for the badge based on Ulta’s criteria but were not labeled as such. Conversely, 2 out of 100 products that were already badged under “Conscious Beauty” violated the badge criteria, including popular items from L'Oreal and Estée Lauder. SmarterX’s assessment underscores the need for brands to conduct regular audits on their products to ensure full compliance with badge criteria, and closer working relationships with retailers to provide accurate labeling and product representation.

Claims Monitoring and Verification

In addition to certifying bodies, such as Carbon Trust and Carbon Neutral, that provide frameworks for monitoring, verification, and reporting of environmental claims. Provenance Framework is a larger body that offers certification and monitoring across various geographies in the beauty sector.

The Provenance Framework (PF) is a data standard developed with international partners to help businesses make and substantiate compliant social and environmental claims, and dispel greenwashing. The PF works with several certifying bodies to assess a business’ operations, processes, and products. The PF was developed in the European Union and U.K. leveraging regional Environmental Social Governance (ESG) methodologies, that are in most cases the highest level of standards that most brands strive to meet in order to operate in those key geographies. The Provenance Framework has several partners in the beauty and sustainability network, including The Carbon Trust, Wrap, Soil Association, The Vegan Society, and Fairtrade.

The PF offers two types of proof points around certifications and claims. Certifications from PF are awarded by third-party organizations who assess a business’s operations, processes, or products. The data points around these pillars are amalgamated and kept on hand when confirmation is received from a certifying body. Brands are required to update the certification with any changes in order to remain or renew compliance and certification standards.

Claims are deployed to fill the communications gaps where brands or products are not certified. Claims are only awarded if a brand or product has met a stringent level of substantiation or has been verified by an approved partner. Claims are processed by PF’s Integrity Team, and issued after a claim is shown as ‘evidenced.’ Claims must be verified by a third-party to ensure accuracy, and expire after 12 to 24 months depending on the proof point and substantiated data.

Within the PF, brands and retailers are able to back the claims made by showing the relevant information and evidence behind the claims. They are also able to showcase their sustainability efforts, ensure regulatory compliance, and synthesize data points around a collection of products in a manner that is substantiated and compliant.

Can the Beauty Industry Reach a Universal Standard for “Green” Claims?

The beauty industry is increasingly focusing on sustainability through a variety of initiatives and practices. Internally, brands are investing in the use of recyclable, biodegradable, and compostable packaging materials, and introducing refillable systems to reduce single-use plastics. Leveraging circular supply chains and local sourcing is another method being used to minimize transportation emissions and support local economies. At the forefront are businesses investing in research and development, as well as collaborative industry initiatives, to drive innovation and collective action towards a more sustainable future.

To effectively communicate a beauty brand’s global environmental impact, it requires the cross collaboration and agreement between several various certification bodies that touch the beauty sector. The bodies that provide certifications or scientific based standards to ensure circularity, can voluntarily co-create and standardize overarching, potentially higher levels of certification. For instance, a singular “net zero” or “carbon neutral” standard could ease the burden placed on consumers to navigate various claims, reduce latency in the supply-chain caused by updating or verifying feedstock or materials processing, and address end-of-life and second-life processes for used products.

To do so, regulatory bodies, certification organizations, and circularity policy makers, would need to reach a new, international consensus about how their services fit into a global model. This would create a framework for how their individual certifications act as a ladder to international certification standards, and harness their collective power to address materiality and supply chain from end-to-end.

“Sustainability and recycling can be such a confusing topic as a consumer, I feel often intimidated by it myself,” said beauty influencer The Glow Scout. “Sometimes it’s hard to differentiate what is potentially greenwashing and what is actual sustainability efforts when it comes to brands…it would be super helpful for brands and companies to come together with a universal standard.”

“We tend to leverage less in more, in the sense of how we consolidate the information that's needed for the consumer to engage and learn in the most effective way possible. Fear mongering also is not our style,” said Fothergill. “If you know nothing about sustainability, you're welcome here, and if you know everything about it, you're welcome here…We try to give consumers the tools to follow through and make changes themselves, or make sustainable decisions themselves. Visual cues have been huge for us, graphic communication, and leaning more into video communication.”

Being able to transparently understand emissions in the complete lifecycle of the majority of beauty products is the beginning. Shared knowledge among brands can advance best practices and ease competition to be the first and only when it comes to sustainability. Instead, sustainability is the baseline for creating products that go-to-market. Verifiable life cycle assessments with data on environmental impact, details on overall carbon footprint, and marks from individual certifying bodies can act as a stepping stone to achieving higher-grade certifications from internationally recognized bodies. This level of transparency includes greater specificity on claims, such as water usage, complete carbon emissions, clarity and education for consumers on how to participate easily in reuse and proper disposal of products.

In the interim, companies that want to be viewed as sustainable, shouldn’t have to fake it until they make it. Existing beauty brands, sustainability consultants, and certifying bodies can forge incubators, designed to support new organizations entering the marketplace. Products that aim to disrupt or improve our beauty routines should not have to disrupt the delicate balance of our fraying ecosystem in the process.

Brands and products that obtain third-party certifications and provide detailed reports on their sustainability efforts are embracing transparency and driving the standard for competition to grab eco-conscious consumers’ attention. There are major efforts by beauty brands to leverage innovation to rapidly understand and reduce their environmental impact. For example, artificial intelligence is being used to quickly assess and detail a product’s composition, and water usage is being reduced through the development of waterless products and more efficient manufacturing processes.

To indirectly combat climate change, companies are actively investing in carbon offset programs and utilizing renewable energy in manufacturing. Recycling and take-back programs are also being implemented, often in partnership with recycling organizations, to ensure proper disposal.

The voluntary carbon market is an important step in this transition as organizations wean off of virgin feedstock, unsustainable petroleum-based packaging, and damaging manufacturing processes. As this transition takes root, how the marketplace looks to consumers would shift and then normalize. Products designed with extra elements would be streamlined. Consumers can begin to understand the reasoning behind certain design choices. For instance, buying a fragrance that feels heavier conveys that an item is of higher value, even though it is more costly for the environment because of its increased packaging. Consumers can also learn how to decipher between different types of materials and labels, and when they can avoid products that contain unnecessary plastic wrapping that is difficult to recycle.

How Can I Make Sustainable Beauty Choices As A Consumer?

Reducing beauty waste can be greatly affected by your choices as a consumer. Selecting sustainable brands that prioritize eco-friendly packaging and ethical practices helps. You can choose to shop at zero-waste stores and buy products in bulk using your own containers. Selecting multi-purpose products can also help reduce or limit the number of products used in a daily beauty routine.

As a consumer, you can also become more well-informed about the waste management and recycling guidelines available in your area. Ensuring empty containers are cleaned before disposal is a significant and often overlooked step. Many recycling or take-back programs give consumers the assurance that their waste is properly disposed of or reused, even though this claim’s authenticity and practice varies. Some brands are engaging eco-conscious consumers by creating sustainable product lines.

Increased education and engagement are essential to reducing waste in a circular beauty economy. Retailers are taking action to help educate consumers about sustainable options available to them, but there is a huge opportunity for brands to lean in and breed greater trust through education and transparency. By doing so brands can stoke affinity based on the alignment of their values and operations with consumers' views on protecting the planet. Brands that do so have the opportunity to lead the marketplace when it comes to the cost, quality, and cost advantages to achieving a circular product.

Moreover, marketers need to scale back the level of packaging that is sent to influencers in order to sway them with an “experience” that is usually filled with additional packaging.

“Sometimes the size of the package that gets sent is enormous compared to the one or maybe two products that are actually in the package,” said The Glow Scout. “I try avoiding showing these huge extravagant promotional boxes because it’s honestly so much waste. As someone in this space, I would love to see smaller and more intentional PR packages.”

To help consumers along the way, brands and organizations can develop collaborative marketing campaigns, using shared resources that may be typically unavailable to them as competitors. With their combined resources attached to its coordination, there’s a greater chance for success and visibility. Engaging with earned media and beauty influencers who are authentically dedicated to endorsing sustainable products would add legs to the effort.

It’s imperative brands invest in dedicated marketing campaigns to educate consumers about how products meet sustainability measures, as well as how consumers can engage in proper waste disposal. By increasing consumer knowledge about sustainable business practices available, brands, media, and relevant influencers can encourage responsible consumption and packaging disposal as they boost a brand’s reputation and affinity.

Case Study: Stratia Skin and rePurpose Global

Beauty influencer The Glow Scout was the first place I learned about women-owned Stratia Skin. Stratia provides a higher level of labeling on its packaging, with claims supporting its ownership, post-consumer recycled packaging, how to dispose of empties on the bottle itself, and certification marks from Leaping Bunny and the Forest Stewardship Council (FSC).

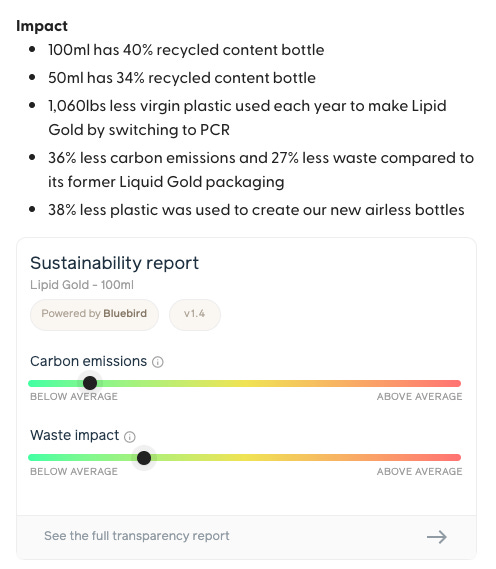

On Stratia’s website products such as its best-selling Lipid Gold feature a tab dedicated to the product’s overarching sustainability. This level of detailed reporting is propelling beauty brands and consumers forward in the distinction between green claims and greater transparency. Its sustainability tab links out to a broader sustainability report with a topline description on how the product performs on emissions compared to a typical moisturizer, its solid waste output, carbon emissions throughout the supply chain, and recycling instructions with a call out to find a Pact Collective recycling bin. Navigating the transparency report enables consumers to learn more about their product’s impact and it provides guidance on each section by hovering about the question mark near the section heading.

Bluebird by rePurpose Global is the organization behind Stratia’s sustainability data and reporting. It empowers businesses to act on plastic pollution and accelerate circular solutions by offering on-demand Life Cycle Assessments, packaging waste & recyclability analysis, and consumer transparency tools for the CPG & consumer goods industry. To date, the company has supported more than 100 leading brands spanning beauty, personal care, wellness, and supplements, such as Stratia Skin, Krave Beauty, Ritual, Summer Fridays, Glow Recipe, ILIA, Dieux Skin, Experiment Beauty, Versed, and Doré, to develop and optimize 1000+ products.

Bluebird has accelerated its ability to assess the impacts of recyclability, waste, and packaging throughout the supply chain leveraging a proprietary sustainability and supply chain datasets. This toolset enables beauty brands to quickly fill the gaps where there may be limited information from manufacturers and vendors, as well as how the product travels throughout the supply chain. By enabling a deeper level of data and assessment, brands are able to meet or exceed consumer expectations, supporting them with guidance on how to participate in ethical waste management. The rePurpose Global team is also engaged with brands on active plastic recovery in India, Columbia, Indonesia, Cameroon, Kenya, and the Dominican Republic.

Leveraging Product Design to Modify Consumer Behavior

There is a substantial opportunity for brands to capture consumer attention as they work to redesign products and incorporate those approaches into their marketing strategies, educating the greater populace on how the circular economy plays in their own brand’s product development. Often, packaging plays a frontline role in attracting and educating consumers, as served by the clean beauty labels leveraged by retailers. Sustainable or circular solutions can aid brands in persuading consumers to buy one product over another at the point of sale, as well as reflect a brand’s values within its packaging. A well-designed package contains an advantage over competitors in the marketplace as it can be used to communicate a product’s value, quality, and brand history.

In fact, a consumer’s perception of a brand can have a significant impact on their purchase decisions. Beauty companies have already begun shifting their approach to developing clean and safe products while coming up with ecologically friendly designs for their packaging. Both approaches help consumers understand the importance of responsible consumption. Consumers, meanwhile, have become more conscious in terms of health and aesthetics in the modern era and are eager to keep themselves updated with the latest trends in sustainability.

But there remains a gap when it comes to education around packaging and brand messaging. For instance, often packaging that is heavier or weighted is deemed of a higher value or quality, even though the packaging exceeds a product ratio in order to instill a sense of luxury. High-quality materials also support the idea that products are of a higher quality, even if this is not necessarily the case.

Some packaging materials lend themselves to a perception of higher quality. For instance, the use of glass gives products an element of elegance and high luxury. Glass is 100% recyclable in a perfect system, but its value is often wasted without sufficient treatment because it costs more to transport glass, and thus it contributes toward a higher carbon footprint under scope 2 emission standards.

Most brands have a core identity, personality, and positioning statement to facilitate a consumer’s perception around itself and its products. Promotional messaging and product aesthetics work together to raise awareness of a brand. Brand’s that achieve familiarity, secure loyalty, and regularly tout notable innovations are able to enjoy a level of salience in the marketplace.

Brand development takes time, and developing loyalty to a particular brand takes even longer. Media and influencers can be equally important in a brand’s rise and fall, as they can provide deeper evaluations around a company’s value proposition, performance, and proliferate loyalty to a certain product based on awards, their own personal use, and reuse.

More and more, brands are integrating elements of their sustainability practices into their packaging designs with claims around the amount of PCR used, certifications from recognized bodies, and instructions on how to properly dispose of a product after use. This makes for an excellent continuation of a brand’s values to the consumer after the point of sale, and supports a consumer’s proper disposal of packaging – if they read. Consumers prefer to glance at images before reading. With this in mind, it’s likely too much onus is being handed over to the packaging to effectively communicate these proof points when greater efforts can be made to educate consumers before making a purchase decision on the lifecycle of any product they may be considering.

It’s in the beauty industry’s best interests to create stickiness with consumers and actively engage them in the sustainability process. As supported by Pact Collective and Bluebird by rePurpose Global, creating a closed loop with consumers is an excellent way to drive business growth via transparency and education. It has the capacity to delight and engage customers in how they can make a personal impact on the planet through their decisions, while leveraging consumer participation toward lowering a company’s overall carbon footprint.

Case Study: Stila and Neem

When I was a teenager, I became obsessed with a beauty brand called Stila. Created in 1994, Stila was the brainchild of Jeanine Lobell, a Swedish-born make-up artist. Its color palettes were the perfect hues of pink, neutrals, and soft pastels, and one of its biggest differentiators on the shelf was that it did not use any plastic packaging. Lobell told Into the Gloss it’s because plastic packaging is ugly.

"'What about paper?" said Lobell. "In the old days, the lipstick tubes used to be paper. The blush came in paper. So I was like, 'Why can't I just do that?'" Lobell found a man in Ohio named Lou Stevens who made cardboard mailing tubes and had him shrink the tubes down to make lipstick holders for her product.

But the Lobell didn’t stop there, Stila’s eyeshadows came in a silver paper pot, its lip gloss came in a minimalist metal tube with a small plastic lid, and often its products were illustrated with a fanciful, fashion depictions – the kind you could find in an aspiring designer’s notebook. Lobell ran Stila for five years before selling the brand to Estée Lauder in 1999. Under Estée Lauder the brand released Stila’s legendary Lip Glaze in a clickable plastic tube with soft plastic bristles.

Today, Stila looks very different. Under the management of private equity firms its products are all contained within plastic packaging designed to convey luxury, mirroring the aesthetic of many brands available in the marketplace.

However, this is not the case for Stila’s originator. Lobell currently owns and operates a direct-to-consumer beauty brand called Neen. Neen operates via a subscription model. Each month, subscribers receive a postcard showcasing five models all wearing the same shades in varying makeup looks. These cards include color samples to encourage trying before buying with a QR code that leads to a video tutorial on the brand’s website. All of the products, postcards and packaging are made from recycled or sustainable materials. Neen’s products are unique in that they are made with first-of-its-kind refillable silicon compacts, Oceanworks plastics that are reclaimed plastics sourced from the world’s waterways and seas, recycled PET, and ethically-resourced mica.

Conclusion

There is a strong and growing consumer demand for sustainable beauty products, especially among younger generations, and they are increasingly willing to pay a premium for products that are environmentally friendly from cradle-to-cradle. However, the complexity of certifications, recycling systems, and varying environmental practices requires a high level of education, transparent communications, and significant investment to move the beauty world toward a sustainable future.

For Beauty Brands

Beauty brands must continue to enhance their sustainability practices by updating and upholding aggressive sustainability goals and practices based on new research, consumer feedback, and technological advancements. LCAs are critical for understanding the environmental impact of products from production to disposal, and brands should continue to leverage them to align with regulatory frameworks and better communicate sustainability efforts to consumers.

Achieving third-party certifications are crucial for building trust. However, there is a lack of standardization across different regions and certifications that creates confusion for consumers. To overcome this, brands need to invest in educational campaigns that inform consumers about proper disposal methods, the importance of certifications, the benefits of choosing sustainable products, and how they can contribute to a product’s end-of-life.

Current recycling systems face significant challenges, including insufficient infrastructure, contamination issues, and the complexity of recycling mixed materials. This underscores the need for substantial investments and improvements in waste management systems. Collaboration among producers, recycling organizations, and sustainability experts is essential to overhaul these systems, integrate new and emerging technology, such as AI, and establish fair labor practices for waste management in developing nations.

Beauty brands and packaging manufacturers are making strides to embrace sustainable practices wholeheartedly and communicate these efforts. Prioritizing the development of recyclable, biodegradable, and compostable packaging will continue to be paramount. To lead the way, brands must explore innovations such as refillable systems and waterless products, which are already gaining attention as first-of-a-kind for their potential to reduce environmental impact and engage consumers in new ways. Shared resources and joint initiatives between brands can drive greater industry-wide progress and consumer awareness on how the system is improving upon itself.

For Influencers

Influencers play a pivotal role in bridging the gap between beauty brands and consumers, especially when it comes to sustainability. As trusted voices, influencers can focus on educating their audiences about the importance of certifications, sustainable packaging, glorifying recycling practices, and eco-friendly purchase decisions. Creating content around how to interpret a sustainability report would certainly differentiate an influencer among competitors who are posting standard “get ready with me” content.

Though beauty brands and packaging manufacturers are making strides to embrace sustainable practices wholeheartedly and communicate these efforts. The gap between experts in the field and consumers on the hunt for their next beauty solution is one that influencers can help fill. Highlighting innovative products that use less resources, contain packaging that is completely biodegradable or recyclable, or that leverages a refillable system can spark consumer interest and drive broader awareness and dialogue. By leading with integrity and aligning their content with sustainable values, influencers can inspire their followers to make more eco-conscious beauty purchases and contribute to greater environmental education.

For Consumers

Consumers, particularly younger generations, are driving the demand for sustainable beauty products and are increasingly willing to pay a premium for eco-friendly options. However, the lack of standardization in certifications can create confusion, making it important for every consumer to educate themselves about what different labels mean and to invest more time in understanding the full impact of any particular product on the planet. Proper disposal methods, understanding the benefits of sustainable vs. ethical products when making a purchase decision, and active participation in recycling programs like those noted above are critical to supporting a circular economy. As the beauty industry continues to innovate with more sustainable packaging and product options, consumers are encouraged to choose brands that demonstrate a commitment to sustainability through clear, credible certifications, transparent reporting, and mindful sustainability practices.

Maura is currently diving into different climate topics – including circularity, decarbonization, energy, and greenwashing – to deepen her expertise and share new avenues of storytelling for climate solutions. Connect with Maura on LinkedIn if you’re looking for a growth-oriented marketing person who can create an epic mythology for your brand, deepen your customer relationships, and drive narratives that transform your business.