Welcome to Climate Drift - the place where we dive into climate solutions and help you find your role in the race to net zero.

If you haven’t subscribed, join here:

Hey there! 👋

Skander here!

In Part 2 of our journey towards a circular economy, we're diving deep into the current state of affairs across five key industries.

Our guide is none other than Nadia, the digital and e-commerce driftie with 15 years of experience working with industry giants like Nike, TOMS, and adidas.

This time, Nadia takes us on a comprehensive tour through the Outdoor Sports, Fashion, Home Furniture, Consumer Electronics, and Food & Beverage sectors. She dissects each industry through case studies and three crucial lenses: the consumer perspective, business, and government.

🌊 Let's dive in

Join the Climate Drift Accelerator and turn your passion into action. We are selecting people for our next cohort now, and we're looking for talented individuals like you to make a real difference.

🚀 Apply today: Be part of the solution

Redefining Consumption - Part 2

State of the industry

(Click the title 👆 to read the full state of the industry online, it’s a long one)

Hi I’m Nadia, a Digital and E-commerce leader with over 15 years of experience in sportswear and lifestyle industries, I bring a strategic mindset with a pragmatic approach to execution. My experience includes working with major brands such as Nike, TOMS, and adidas, among others. I have a deep yet comprehensive understanding of the dynamic and ever-evolving landscape of consumer behaviour, business, and technology. Driving 80% growth in corporate set up by delivering relevant consumer experience and fostering close collaboration with key stakeholders.

After developing circular services pilots, I’ve come to see the circular economy as a logical and exciting model for the future. It aligns profitability with sustainability, offering clear value to consumers—a business approach I strongly believe in. I specialise in identifying value exchanges between businesses and consumers, crafting innovative value propositions and business models that deliver creative and impactful solutions.

This is the second part of a three-part Challenge:

Part 1. Collective Action, the Key to Transition from Ownership to an Access Economy

This chapter talks about consumption as the root cause of our climate problem, and provides a framework for the next chapter. While consumption is an inevitable part of human life, we must ensure it stays within acceptable limits to protect our planet’s boundaries. Managing consumption requires a collective effort—discover your role in shaping this.

Part 2. State of the Industry through the Lens of Consumers, Business, and Government

Deep dive analysis of 5 industries current situation through the lens of consumers, business, and government using the framework outlined by the first chapter. Understanding the role they play, challenges, and best practices unique to the industry.

Part 3. Building a Circular Future: a Practical Guide to Starting a Circular Business model

A step-by-step guide on launching a profitable circular business with a clear value proposition for consumers, focusing on building a systemic approach to transform the business model.

INTRODUCTION TO PART 2 – THE STATE OF NOW

Our current system was designed to incentivise more and more consumption. Countries and governments around the world use GDP as a measurement for success. GDP measures market output, which is the monetary value of goods/services produced in an economy during a given period. Businesses are measured by how well they do in a stock market, resulting in volatile short-term thinking. Consumers spend a significant amount of time on social media, where they are exposed to information and ads that brands target, often leading to impulse purchases.

To transform the current system it will take more than one player, in fact the only way forward is to collaborate and find creative solutions that incentivise everyone to participate.

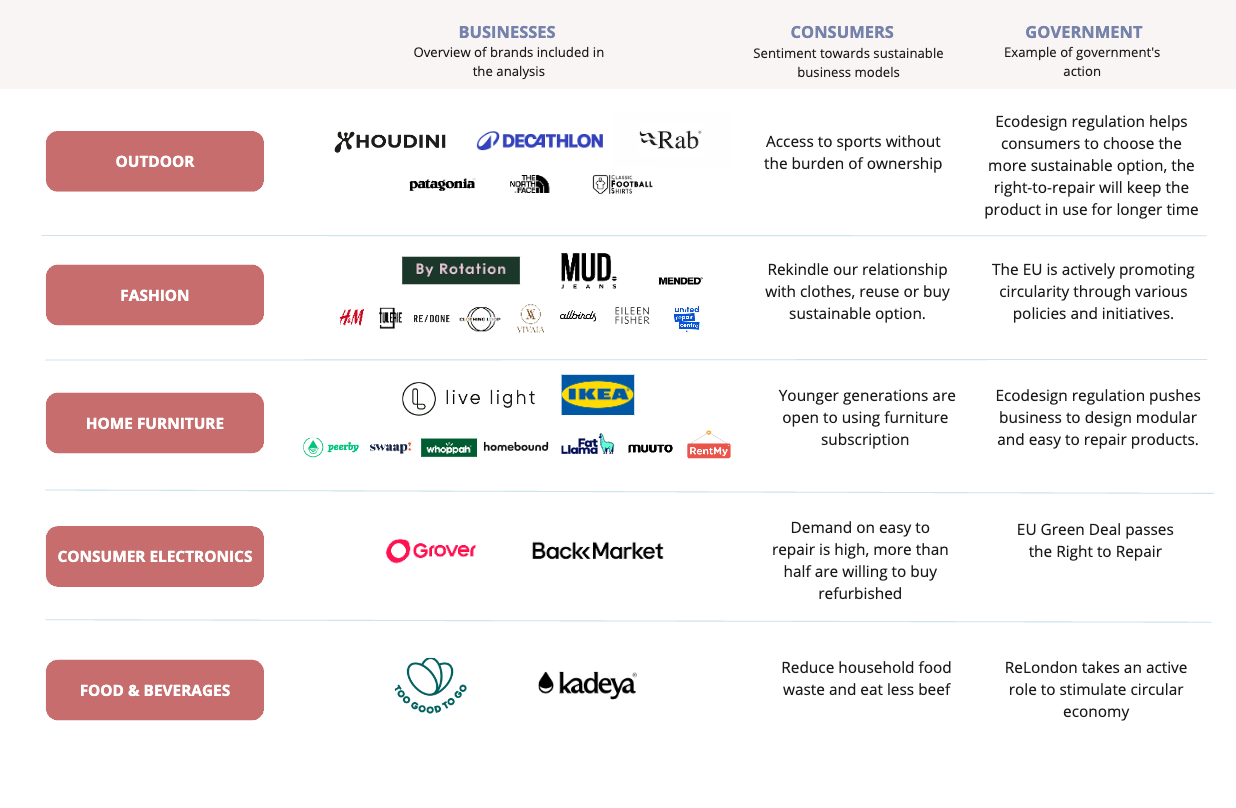

Every industry addresses distinct consumer needs and encounters challenges unique to its business model and operations. In this chapter, we will delve into five different industries (see logos of brands included in the analysis above), examining each one individually.

Table of Content:

Outdoor Sports

Fashion

Home Furniture

Consumer Electronics

Food and Beverage

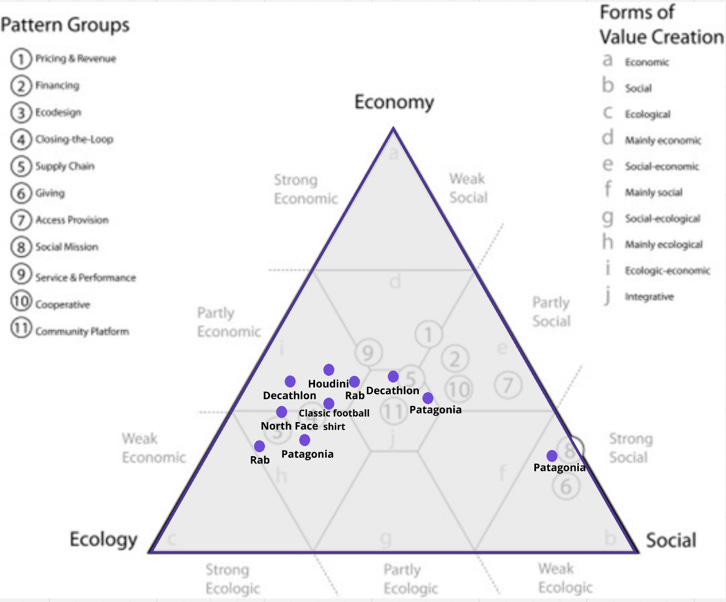

I will analyse each industry with frameworks from Part 1:

The role of each player: consumer, business, government

the different patterns of Sustainable Business model innovation

OUTDOOR SPORTS

Consumer | Access to sports without the burden of ownership

The increasing focus on sports and outdoor activities globally started during the pandemic in 2020 when the lockdown developed a realisation of how movement and mental wellbeing affect each other. At the same time being in the open, experiencing fresh air and nature became a luxury and a way to have a break without being in a crowd.

For today’s consumer, access to sports and the outdoors has become essential. Referring to the Pyramid of Needs by Maslow, sports and outdoor fulfils the following needs: health & wellbeing (safety), sense of community (love & belonging) , increased self confidence (esteem), and sense of achievement (self actualization) all together. This is the reason more people are entering the sports and outdoor market.

Trying out new sports brings the excitement of purchasing new gear as well as the uncertainty of sustaining the routine in the long run. Let’s look at an example of taking up hiking for the first time: it’s considerably an accessible sport. The only 2 things you need to start the activity are hiking boots and access to nature. A pair of comfortable and waterproof hiking boots could set you back more than €200. What if there is a possibility to rent it for a week with only 20% of the cost and the possibility to buy or return it?

Business Model | There is Economy opportunity for professional maintenance and Product-as-a-Service

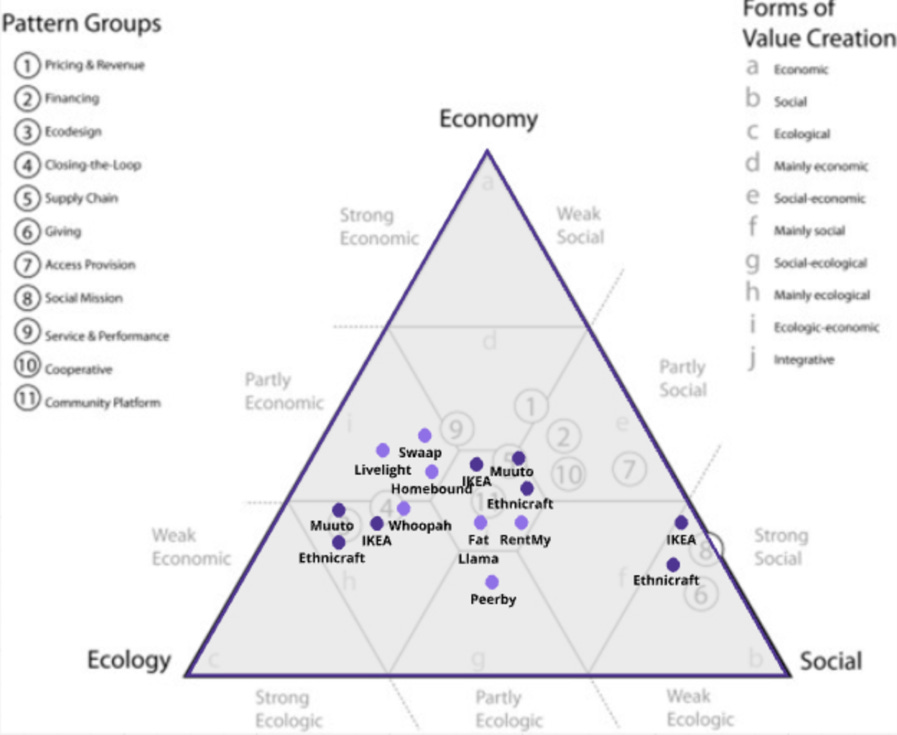

In the picture is a sample of sportswear and outdoor players, which have applied sustainable business model innovation into their current business. One thing that is important to take into account is the size and scale of the business. The larger the business the harder and longer it takes to transform their overall business model.

Patagonia has built sustainability throughout their business model and culture, inspiring circularity adoption within the industry. North Face as a publicly owned company has integrated sustainability throughout their value streams, followed by circular services with their renewed, mend, and takeback program.

Classic Football Shirt resell classic jerseys from previous seasons/years. Following the latest trends of football jerseys entering the mainstream sportswear and nostalgia market, this is a hot space in the market.

Let’s zoom into these 3 outdoor brands with different scales:

Houdini

Houdini is a niche Swedish outdoor brand that focuses on activities such as hiking, running, and climbing. Sustainability practices are embedded throughout their value streams from production to business model. They are considered a pioneer in the circular business model, with 85% of the collection already circular.

The outdoor brand is a thought leader in leveraging digital solutions to accelerate circularity. In 2021, they explored emerging opportunities by embedding IoT technology into apparel, which is now known as the Digital Product Passport. In their first pilot, users could connect their apparel to smartphones and share their adventures. Since then, their vision has expanded to highlight individual contributions through product care, increased usage frequency, and a shift in mindset from consumer to caretaker.

After piloting different business model innovation, including access-based business models the brand created Houdini Circle - a seamless, circular, and user-centric ecosystem where the best practices of circular business models and services merged into one platform. Giving the choice to consumers whether to buy, rent, or subscribe based on their unique needs. In addition the Circle provides access to workshops, experiences, and made-to-order exclusives.

Decathlon

Decathlon is a large-scale sports business with a wide range of gear. They distribute in 57 countries with 72 warehouses and logistics centres. In 2022 they were a €15.6Bn business. Sustainability is embedded throughout their value chain with detailed reporting as well as culture. Employees receive proper onboarding and education about sustainability and actions to take within their work and lifestyle.

By the end of 2023 their circular business accounts for 2.3% of their overall revenue. Even though it’s still quite small compared to the whole pie, the growth of all circular categories (rental, product buy-back, and repairs) are in triple digit compared to the previous year.

Zooming into Rentals, the global French brand currently offers 3 different services:

Short term | hours, daily, season mostly for outdoor sports (winter sports, water sports, cycling, camping and trekking).

Monthly (subscription) | available in France and Spain it’s offered for categories like dumbbells, bikes, golf, and kids tennis rackets.

Long term | 12-24 months | mostly bike lease, currently only available in France through an external intermediary

For a large business that operates internationally, the complex operation, regulation, and cost could give them a real challenge to scale. Therefore to build a successful circular business it needs to be embedded into their long term vision and strategy, coupled with leadership that fully supports it. I believe this is the case for Decathlon.

Rab

Rab is a privately owned outdoor company founded in 1981. Their assortment includes hiking backpacks, waterproof apparel, sleeping bags and tents, all with highly technical details and intricate performance materials.

As a brand, Rab claims to have provided care services for 40 years, and it has been part of their DNA.

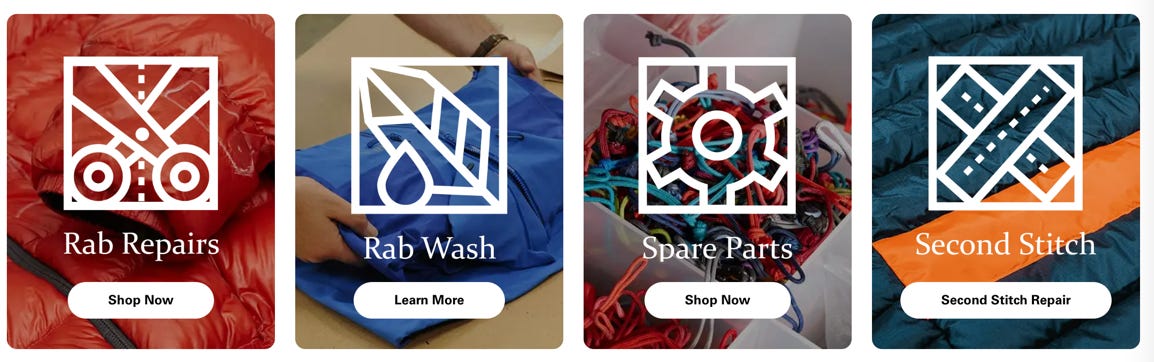

Rab extends their professional services beyond the point of sale in 4 different ways:

Rab Repairs | cost: €12- €20 | all gears are repairable including new zips, straps, or panel replacement

Rab Wash | cost: €15- €35 |offers professional wash for GORE-TEX materials, waterproof jackets, sleeping bags, and soft shells

Spare Parts | providing a range of spare parts to replace worn out ones and patches. Detailed instruction is included for a self service repair

Second Stitch | cost: €12- €15 | the lowest impact repair option using end of life fabric roll-ends. It usually comes with colour contrast which is completely unique

Rab’s well thought offering for maintenance and repair shows their experience in optimising the process. Using leftover fabric from production for a second stitch is a simple yet brilliant idea, for the reason it’s reducing production waste, yet at the same time shows a unique badge that speaks to a sense of belonging within the outdoor community.

A couple of years ago I bought waterproof hiking pants from Rab, and after my first hiking trip in Iceland the edge chafed heavily against my boots and started tearing. I was so disappointed but still love the pants, and I didn’t know about this great service they offer. For products as technical as outdoor gear there is an opportunity to communicate these unique selling points pre-purchase. Most people wouldn’t know how to repair technical gear themselves, therefore it gives comfort that there is professional support.

Marketing

The consumers who buy into outdoor brands are usually environmentally aware, therefore marketing campaigns around climate activism that Patagonia activated, work very well on this target group. Patagonia has also experimented with anti-consumerism ads during black Friday, which is a bold move yet well received by the audience, they just get it.

Government | Ecodesign regulation helps consumers to choose the more sustainable option, the right-to-repair will keep the product in use for longer time

The EU ecolabel regulation was created to promote those products that have a high level of environmental performance. Given that outdoor products often contain a complex mix of chemicals that can be harmful to the environment, this regulation should help consumers more easily choose the more sustainable options.

The right-to-repair under the EU Green Deal will further entrench repair as the preferred option when it is more cost-effective. For outdoor products, which are typically high-quality and made from complex materials, this is excellent news, as it will enable consumers to use their gear for a longer time.

Conclusion:

There is a good synergy and momentum between the stakeholders aiming towards the same direction. The Outdoor sports marketplace is spread across specialty and niche brands with a few big players. While it’s easier for smaller brands to pilot new sustainable business models, the bigger brands like North Face and Decathlon are on the right track, with Patagonia paving the way. Big brands have to follow suit when consumers are offered a more sustainable option elsewhere (and because outdoor consumers are conscious and demand more sustainable products)

FASHION

Consumer | Rekindle our relationship with clothes, reuse or buy sustainable option

There is a big question behind the reason we wear and buy fashion, even for people who make a statement of “I don’t do fashion”, what they wear or don’t wear is a statement. Most people who care about fashion tend to say fashion is their individual expression. However this statement begs a question, if that is the case why do we see people wearing very similar outfits on the street and on social media?

Most people belong in the category of fashion followers, they use fashion as a sign of belonging to a social group. When you see someone wearing something similar to your style, it gives a sense of comfort and familiarity.

Fast fashion tapped into this fashion followers’ need some time ago, providing the possibility for consumers to invest less and give immediate reward to keep up with the fast pace of trends. Slowly changing our relationship with the clothes we buy. We care less about how it was made, who made it, how it damaged the planet in the process, or the quality of it. Most of Gen Z grew up with fast fashion, this is the quality they are used to. Changing their mindset will require education.

Our job as consumers is to rekindle our relationship with clothes without abandoning our need for belonging. Rethinking what is already in our wardrobe and understanding the impact of impulse buying created by social media and fast fashion brands. As consumers our power is our choice of consumption, reuse as much as possible and choose for sustainable options when we have to buy.

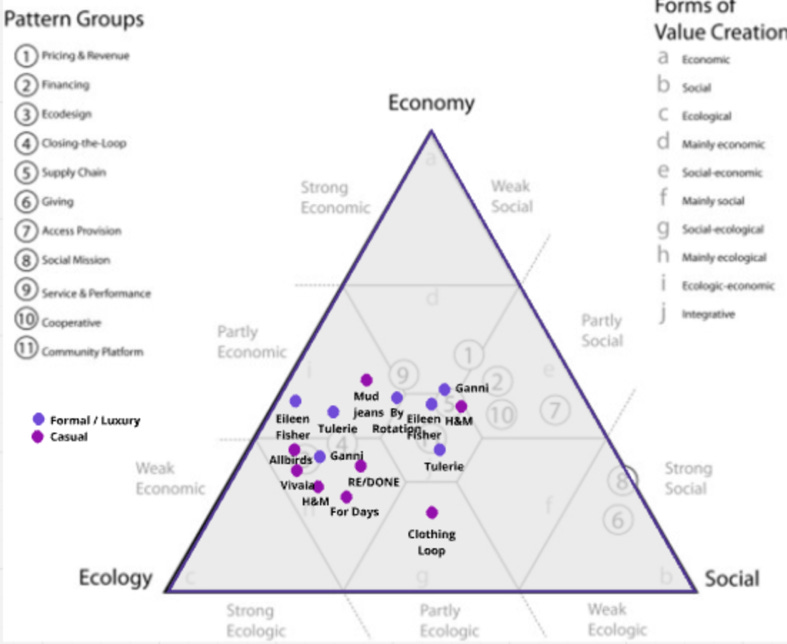

Business | Emerging niche players piloting circular business models, challenging big brands

Within the fashion industry there are emerging smaller players that build their brand fully around a closing-the-loop business model and ecodesign. Even though their scale and influence on the overall industry remains to be seen, they are a breath of fresh air within an industry that has been following the same patterns for a while.

I have categorised the brands into two:

Formal/Luxury | high price point, targeting special occasions

Casual | medium price point, clothing worn for day to day activities

Vivaia and Allbirds are footwear brands focusing their efforts on ecodesign, using recycled materials and regenerative agriculture. Re/Done is a brand started with upcycling vintage jeans and branching out into refurbishing and manufacturing with recycled materials.

Tulerie is a peer to peer rental platform for luxury clothing based in New York. Clothing Loop is a neighbourhood community platform for clothes swapping in Amsterdam.

A few big brands like H&M and Eileen Fisher which have been in the industry for a while are transforming their business into a more circular model. Eileen Fisher’s collection is designed to be timeless, high quality, and easy to mix and match, this way consumers are more likely to wear it for a longer period.

By Rotation

Founded in 2019 the luxury rental app now has over 150K user base and over 120K items to choose from. By Rotation is a peer-to-peer platform that connects a community of fashion enthusiasts and environmentally conscious. Focusing on luxury and special occasion dresses it allows lenders to earn money from an item they have usually worn once or twice, and for renters to get access to unique dresses they might not be able to afford otherwise. With this business model By Rotation doesn’t own any of the inventory, therefore doesn’t contribute to more waste in the landfill.

Here is how it works:

Lenders

Take pictures and list their items with descriptions, price, and dates they would like to lend

Get notified when someone is interested, just like AirBnB they can reject or approve and communicate directly with potential renters

Arrange a meeting point or via post

Once the rental period is completed receive the money in their account within 8-10 days

Responsible for cleaning, sustainable cleaning service is provided for an additional fee

Renters

Browse through the listing on the app, once a match is found request to rent an item

Select the period to rent and send the request, communicate directly with lender within the platform

Once rental is accepted renters will be charged the price with postage and service fee

Arrange delivery via in person meeting or by post, receive the item

Once rental is completed, share feedback and their look on social media

Usually peer-to-peer platforms find it challenging to control the quality of product imagery and have a standardised approach to show the listings. However I applaud By Rotation on their listings, it looks amazing and neat. This is a crucial part of an e-commerce platform as renters only see the products by pictures and a messy listing makes it look unappealing.

Furthermore, their increasing user base proves a community that is ready to let go of ownership and embraces sharing. Opening the door of luxury fashion to be accessible to a wider audience.

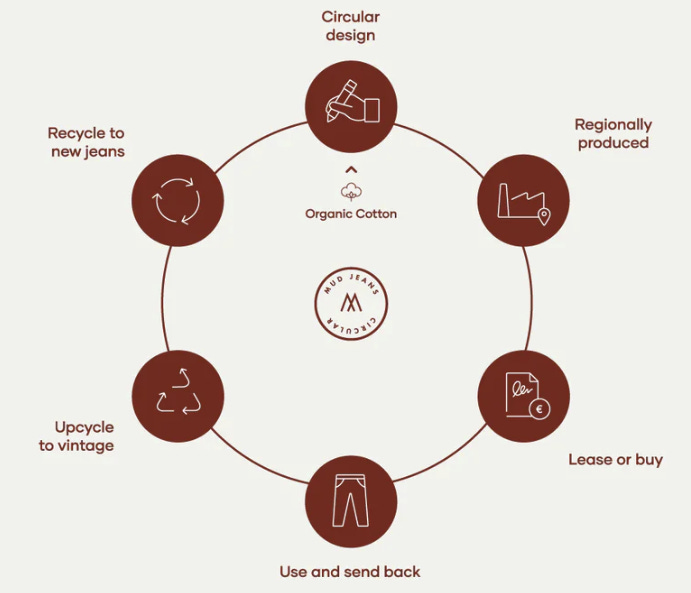

Mud Jeans

Traditionally jeans manufacturing requires a lot of nasty chemicals in the processing. Mud Jeans was invented with the purpose of reducing production waste as well as closing-the-loop. Their end to end business revolves around a circularity model.

Mud Jeans offers various services from leasing, takeback, upcycling, and repair. For repair they partner with a company called Mended.

Let’s dig deeper into leasing and how it works:

Price range: €10 - €13 / month

Consumer can choose the type of jeans they like the best from the assortment for the period of 12 months

Monthly fees apply

After 12 months consumers get to decide to keep the jeans or return them for free

Repairs are always for free within or after the 12 months period

Overall the assortment looks up to date with the latest trends and it offers different cuts (tapered, straight, skinny, wide) to cater to a wide range of audience. The Dutch brand also gives the option to buy or lease, and the price at the end of the 12 months would amount to the same price. This makes it more affordable for younger consumers who would usually opt for cheaper options due to budget constraints.

Marketing | Will Social Media Trends Help Sustainable Behaviour in the long run?

Both Millenials and Gen Z spend a lot of time on social media, and brands have long realised the power of social media marketing. TikTok’s unique algorithm allows smaller brands to thrive and reach the right audience, influencers who understand their audience get commission from brands to create awareness as well as sell their products. Big brands have caught up and ride on these trends as well, #tiktokmademybuyit was trending for a while, accelerating impulse buying behaviour which leads to accumulated waste. However recently #deinfluencing is trending, influencers started to blacklist items and brands. The message is you don’t need these products, to encourage tiktokers to be mindful of what they buy and whether they really need it. There is a chance this is just a micro trend that will go away soon, however for now the only thing brands can do is engage in the conversation.

Government | The EU is actively promoting circularity through various policies and initiatives

The EU has presented a strategy for circular textiles, by 2030 all textiles need to be durable and recyclable, largely made of recycled fibres, free of hazardous substances and produced in an environmentally friendly way while respecting social rights. Fast fashion should be ‘out of fashion’ and re-use and repair services would be widely available. Textiles should be collected at the end of their lifetime and their incineration and landfilling reduced to a minimum thanks to innovative fibre-to-fibre recycling.

Here we see an outline of regulation pushing for the fashion industry to change the business model, explicitly mentioned in the strategy. A government that understands it requires a systemic change from the industry to enable consumers to change their mindset and habits.

We can expect each country's government in the EU to incentivise businesses that provide repair services in the near future, opening up new repair centres accommodating several brands such as United Repair Center. This also creates new job opportunities that require different skills.

Conclusion:

The fashion industry will only transform when consumers change their consumption habits. Regulation to kick-out fast fashion is helpful but not enough. We need to educate the younger generation to buy into quality instead of quantity. There is a gap in sustainable fashion marketing, they need to hire the best marketers out there who understand the target group.

HOME FURNITURES

Consumers | Younger generations are open to using furniture subscription

Purchasing furniture is a big investment for consumers, and often coincides with moving to a new home. Consumers might need furniture for a short period when they are renting in a new city where they plan to stay temporarily, or to a new home they purchased and plan to settle in for a longer period. Moving is itself a stressful activity, coupled with the financial stress of buying/renting a house.

Globally on average around 60-70% of people own their home while 30-40% rent, this data varies per country.

While home ownership is still on the higher percentage, the younger generations are likely to prioritise experience over ownership. Therefore subscription based services have become popular. A survey by EY found that 30% of millennials are open to using subscription services for home furniture. This trend of looking at furniture as access over ownership is driven by a couple of factors:

Growing number of people living in urban areas where mobility and space are limited

More people understand the impact of manufacturing on sustainability and become more conscious

Increasing amount of people moving to work or study abroad

Warming up to the sharing economy driven by the success of businesses like AirBnB

Business | Strong economy for rental and subscription model

Product-as-a-service, especially subscription and rental within the furniture industry is a model that has been adopted by some brands. It seems the economy of rental and subscription works in this industry independently from close-the-loop and ecodesign. While in other industries the brands that provide ecodesign also start adopting product-as-a-service, here in the furniture industry there are brands that just offer rental without looking at other sustainable business models. This is a positive sign where the economy of the model is strong, however it seems there are fewer players that have implemented sustainability throughout the whole value stream.

Livelight, Swaap, and Homebound are brands that fully embraced the rental model throughout their business model. Whoopah is a furniture resale marketplace for peer-to-peer and professionals, they provide secure payment and logistic solutions.

Fat Llama, RentMy, Peerby adopt peer to peer model rental. While Fat Llama and RentMy allow the lender to earn money, Peerby is purely a community platform.

IKEA and Muuto are the bigger players that have looked at the whole value stream to be a more sustainable business at scale. However IKEA has also embedded it into their business model and social mission, taking it further than Muuto.

When it comes to refurbished and remanufactured, there is not yet a big enough player or platform that facilitates the service. Most of them are one man/woman businesses with limited amounts of assortment and service to offer.

IKEA

IKEA started their journey in 2015 to become a sustainable and fully circular company by 2030. Yes, it takes that long for a company at this scale with 473 stores in 63 markets. It requires a commitment and continuous alignment for every stakeholder to move towards the same goal. IKEA’s strategy includes the point of view of Circular & climate positive, Healthy & sustainable living, and Fair & equal. Covering the ecological, social, and economy sides of sustainable business model patterns.

To be a fully circular a company requires looking at the way products are designed prior to creation, making sure it’s designed to be Reused in the second hand market, Refurbished easily, dismantled for Remanufacturing, fully Recyclable when it’s at the end of lifecycle to become the next raw material. All of these processes need to have consumers in mind because they are the one who will use and experience the products.

There are many lessons we can learn from IKEA’s journey in becoming a fully circular company, considering the scale of the business this also gives hope and should inspire other global corporations.

Let’s deep dive into one of their learnings, IKEA has assessed 9,500 articles to understand the capabilities needed to make a product circular, here are the key takeaways:

Designing for standardisation and adaptability enables reuse and refurbishment through scalable maintenance and repair possibilities with standardised spare parts and remanufacturing by reusing parts in other products.

Material choice and how they are combined are the key enablers for recycling and the extension of material life. Using the right material for the expected lifespan based on expected use, minimises unnecessary waste and misuse of materials. It also enables recycling by simplifying the process.

Home furnishing accessories have a higher rate of existing circular capabilities than furniture. This is due to, for example, the simpler construction in terms of components and material mixes.

Leading up to their goal in 2030 and beyond, the opportunity for IKEA to become a fully circular company, is an exciting one. While keeping their affordability for the same target group and extending the durability of their products, the Swedish brand could play a stronger role in the product-as-a-service model. Building the economy around access and sharing instead of ownership could be an interesting space for them.

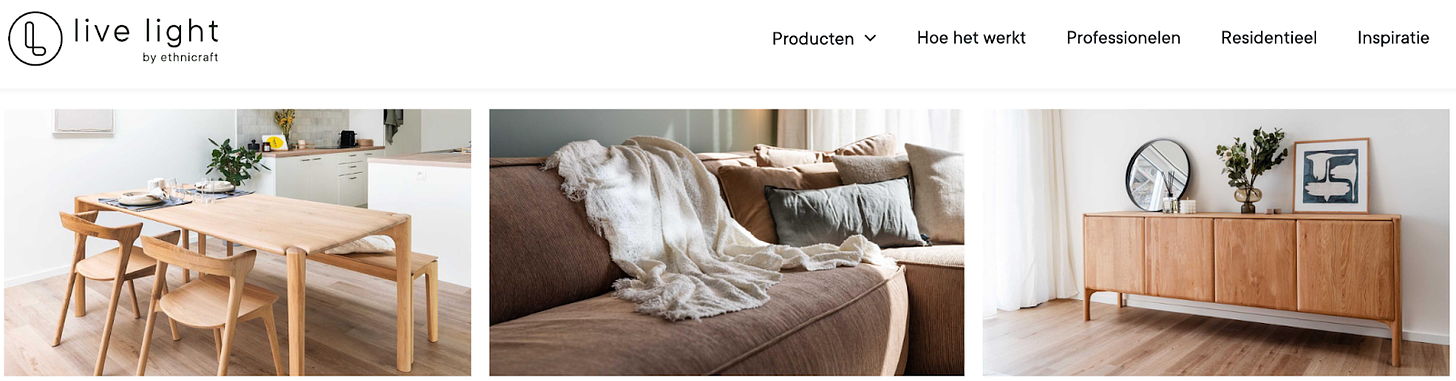

Live Light

Live Light was born in 2020 from mother company Ethnicraft which was already in business for 25 years. It’s a subscription model business with products selected from the collection of high-end and durable furniture. Live Light is currently operating in Belgium, Netherlands, Luxemburg, France and Germany. Ethnicraft has applied ecodesign and green supply chain throughout their production process therefore Livelight collections are sustainable by design.

Every piece was made from durable materials, with wood at the core. The wood is sourced from Indonesia where they have also contributed to the training of local craftsmanship. The collection is beautiful, high quality, and timeless.

How does Livelight work:

Browse from the collection of products, and choose the minimum subscription from 1-48 months

Pay the first 3 months and delivery fee upfront to confirm the order

Delivery and assembly cost for €149-€199 depending on location

There will be a monthly charge to credit/debit card

Send back the item whenever you are ready. Swap for something else or buyout the furniture

Consumers can change subscription plans on the go and items are refurbished when they are sent back. Light wear and tear are also tolerated and repair is free of charge.

Ethnicraft products are on the high end of the industry spectrum, therefore the subscription model offered by Live Light opens up access to a different target group who might usually not consider Ethnicraft because of the price range. This is beneficial for both consumers and the business. Meanwhile, by retaining ownership of the items Live Light takes back control in terms of care of the products and keeping these items in play for a longer time.

Government | Ecodesign regulation pushes businesses to design modular and easy to repair products

The Eco design regulation by the European Green deal will push furniture businesses to design products that are more durable, made of eco friendly materials, and modular. At the same time the Circular Economy Action Plan (CEAP) will ensure products are reused and last longer, and parts are easy to re-assemble and repair. In the future new businesses will thrive, such as services that help with professional repair and furniture upcycling, creating unique pieces and reusing old parts.

Conclusion:

There is momentum for the home furniture industry to adopt sustainable business models from ecodesign, close-the-loop, and PaaS. Consumers are open to these models and there is a strong economy behind it. The government is supporting and in the future will incentivize the new model.

CONSUMER ELECTRONICS

Consumers | Demand on easy to repair is high, more than half are willing to buy refurbished

A single household in an advanced economy usually owns 10-30 consumer electronic products on average. When we talk about consumer electronics, these are products in our daily life such as smartphones, laptops, fridge, washing machine, TV, smartwatches, etc. Largely the use time of smartphones is between 2-3 years and a laptop 3-5 years.

For consumers the ownership of these products is an interesting one as it has entered into various layers of our life. For some people this is part of esteem, showing off their status as avid tech followers. However, getting access to smartphones has also become a fundamental need for communication and education.

Circle Economy mentioned 80% of consumers in the EU agree manufacturers should be required to make devices easy to repair, while 52% declared they are willing to buy a refurbished smartphone in the future.

With such a dynamic industry and technology trend, the concept of ownership almost doesn’t make sense. The brands launch new versions with the latest tech every year, creating a market that forces consumers to buy the latest and greatest even though their current device still functions perfectly. For some consumer segments who are less sensitive to technology and are willing to keep their device longer, repair is an important option to fall back into. However most devices were not designed to be repaired, unlike in the old days.

Business | Adopting Product-as-a-Service will reduce cost overtime

There is resistance within the overall electronics industry in transforming the business model from a linear to a more circular one, in most cases due to a perception it would be a trade-off to financial performance, and due to complexity of the supply chain transformation. Therefore let me open up a different perspective to prove it otherwise through the lens of these 3 opportunity spaces:

High Product Value | most products manufactured are with high quality, could last longer than currently used, and have the opportunity to be refurbished and passed on to more users

Price elasticity and broad market segments | it’s a growing market across the globe with diverse consumers’ need, which means there are opportunities to target consumers that need different performance and have different price sensitivity

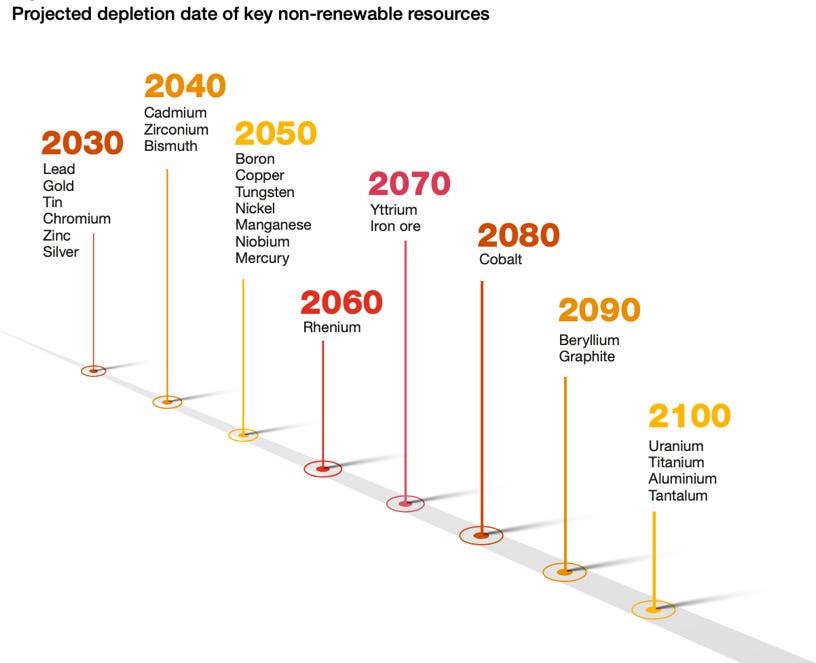

Depleted non-renewable materials | Production of electronics requires a large number of scarce raw materials and there are finite resources. Over time this will mean the price of these rare materials will increase and companies that keep a linear model will have more expensive production costs

In a linear model the material value erodes throughout the use phase until it is negative at the end of life, while circular models strive to maintain the value of those materials until the end of life. Knowing we don’t have enough raw materials to continue doing business as usual, this is the first important argument to transform into a circular model.

PWC: Future Proofing the Electronics Industry projected raw materials needed to make electronics will be depleted overtime. Let’s look at materials that will be depleted by 2030 and take the example of our smart phone. To manufacture a smartphone, it takes 50 different raw materials with 14 key materials. Within these 14 key materials are gold, tin, zinc and silver, all of which are projected to be depleted by 2030.

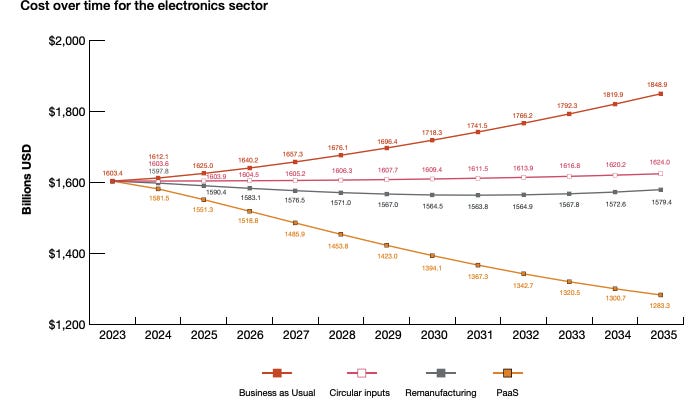

In terms of financial sense, once a circular business model is set up the business will become more resilient and future proof than when staying on a linear model. Let’s look at the options of these 3 circular models and how it helps reduce cost:

Circular Inputs | using recycled materials in the production process, lowering the emissions from extraction of raw materials

Remanufacturing | extending the life of used materials without recycling, and using it for the next product

PaaS (Product-as-a-Service) | allowing products to be used multiple times by different users, catering to the fluctuating needs of users. This also incentivize producers to create durable products

It’s time for the consumer electronics industry to rethink their business model. If brands were to design products with higher quality and have more thoughtful research and discovery, instead of pushing themselves to launch something new every year, it will lead to a more transformative type of innovation. On the other hand, the brands need to start exploring new business models that would cater to a wider consumer base who would choose for access over ownership and the option to repair their device to keep it longer.

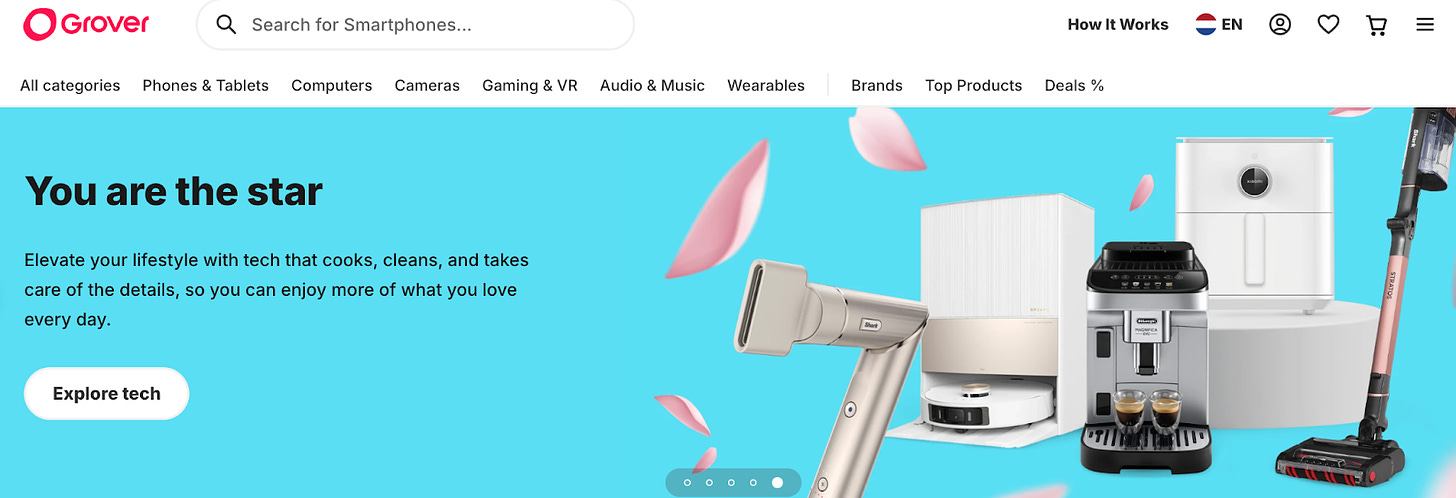

Grover

A subscription based tech rental company with over 5,000 products, including smartphones, laptops, VR gear, wearables, and home appliances. Grover leads the consumer electronics rental market in Europe and is recently expanding into the US. The business model allows consumers to try the latest tech without the burden of ownership and 90% damage coverage.

How does it work:

Browse on the Grover site from wide range of tech products

Choose the duration of rent from 1 – 12 months

After an order is placed, Grover runs a credit check within 24 hours and users will receive an email confirmation with shipping details

During the rental period Grover covers 90% of damages

Once the rental period ends, users return the product and all data is wiped and hardware refurbished

Rental and lease business models like Grover prove devices can last longer and that consumers are ready to let go of ownership of these products. On the other side, the business is heavy on capital because they have to buy the devices in advance before getting a return on investment. This is something to keep in mind for any business who would adopt this model.

Back Market

A leading company in the refurbished and re-commerce market in Europe with 44% market share in the UK. Originally from France, the company has expanded to 18 countries. The target consumers are users who are environmentally aware and/or price sensitive, as well as the younger generation. It offers significant savings on refurbished smartphones and all devices are guaranteed to be in perfect working condition.

Back Market connects users who would like to trade-in their older device with potential consumers. In the process they work with professional refurbishers that guarantee every device to be restored into perfect working condition according to industry standards.

How does it work?

Trade-in

Choose the device you want to sell with a predefined form

Get an offer within 2 minutes

Transfer your data and ship the device within 21 days

Receive payment within 5 days

Buy refurbished

Browse from a wide range selection of products

Choose the most desirable item, colour preference, storage and add to cart

Free delivery and 30-day returns

12 months warranty

Buy with less by trading-in your old device at the same time

This business model is less capital heavy since they are circulating devices without buying their own inventory, their value is on the service side by refurbishing, ensuring quality, and a year warranty for repairs.

Government | EU Green Deal passes the Right to Repair

The most exciting regulation within the European Green Deal for the electronic industry is the Right-to-Repair. Its purpose is to encourage sustainable consumption by providing repair as the first option when damage occurs. Manufacturers must provide repair first if this were the cheaper option. I find this part open for interpretation since most of our electronics were not made to be repaired.

What else does it mean:

Consumers have the right to request a repair to the manufacturer under the EU law

Standardised repair guidelines for pricing, conditions, timelines

Centralised online platform to matchmake consumers to repairers within EU borders

Warranty period of 12 months after repair

In France the government incentivises consumers to repair by giving a significant amount of deduction on the repair bills, in the hope for consumers to opt for repair.

Conclusion:

The industry is not yet ready to adopt sustainable business practices, especially ecodesign is challenging because of the amount of raw materials needed. However the consumer demand for repair, rental, and refurbished is strong and there is a clear path for profitability. Government support and push are also on the way.

FOOD & BEVERAGE

Consumers | Reduce household food waste and eat less beef

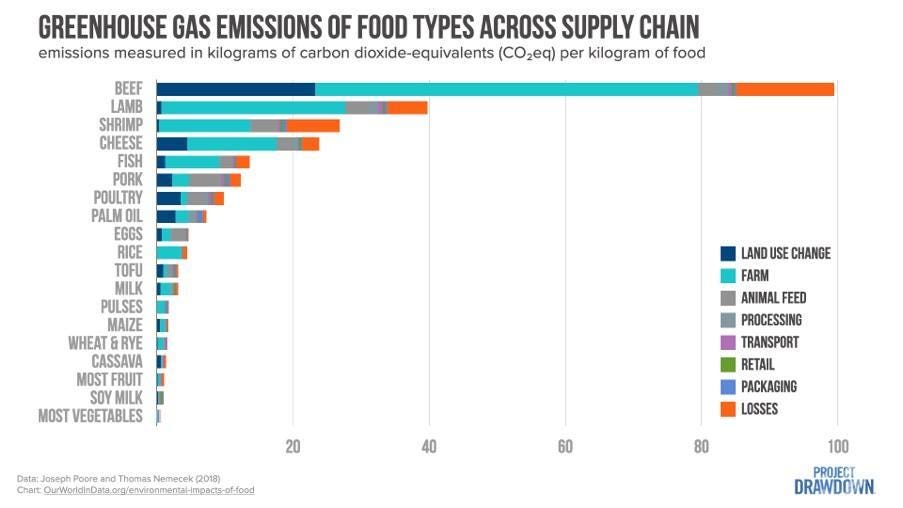

Project Drawdown: Fixing food’s big climate problem highlighted, more than 30-40% of the world’s food is never eaten due to excessive losses in the supply chain (±13%) and food waste (±17%) by consumers. Next to this the choice of our daily diet could have a big impact on the amount of greenhouse gas emissions coming from agriculture. Beef, lamb and shrimps contribute most to GHG emissions. Therefore if we collectively eat less beef and replace it with another protein like chicken or plant based, the result will be significant.

Food and beverage is something humans need everyday. Therefore the action is not to reduce overall consumption, since we need the nutrition to live a healthy life and go about our daily business. We need to be more efficient by reducing waste, and at the same time individually become more aware of the impact of our protein consumption choice.

Business | An opportunity for a scalable and profitable solution to food waste

As mentioned earlier, 13% of food is wasted from farm to retailer, most cases this is due to poor storage, inaccurate forecasting, and a big part is a phenomenon called the ‘ugly produce’. The ugly produce is simply funny looking fruits or vegetables, which taste as normal. Imperfect Food is a grocery service that sells these odd looking ingredients at lower prices. There are also community based organisations that tackle the problem locally such as Ozharvest in Australia and Taste Before You Waste in Amsterdam. Mill offers a solution to automating food recycling.

Here are two examples of businesses that tackle climate problems in food and beverage that I would like to deep dive into.

Too Good To Go

Offering solutions for food waste catering for both the end consumers and retailers, Too Good To Go started with an app that match-makes local restaurants that have leftover products to sell to consumers each day. Consumers are able to schedule their pick up time which is usually at the end of the day and enjoy a selection of leftover delicious food which otherwise was going to be thrown away. For restaurants this is also a way to get new consumers to try their establishment at a lower price.

Realising an opportunity to expand their business and tackling food waste through supporting retailers, Too Good to Go have come up with a B2B solution called the Business Solution platform. It’s an interface that offers an end to end solution of digitalized inventory and expiry date management, to further recommend actions such as: sell on TGTG surprise bag, discount, or donate.

Too Good To Go tackles food waste from both consumers and retailers, addressing the whole system at the same time helping businesses to be more efficient in their operation. Costs associated with food waste make up 2% of retailers’ net sales, reducing this is improving their average margin.

Kadeya

The first company in the world to track hydration and offer bottling as a service, reducing single use plastic. Kadeya operates in a closed-loop environment serving workers through hydration stations. Currently the solution is only offered within a controlled environment such as factory, warehouses. It also offers selections of beverages from consumers’ favourites such as Gatorade and Stur.

Consumers simply find a Kadeya vending machine, pay and grab their favourite drink packaged in a Kadeya metal bottle. Once they finish the beverage, find a Kadeya station where they can give back the bottle to be sanitised and reused. Their bottle return rate so far is 99%, however as they expand into various environments this figure might change. Manuela Zoninsein, the CEO of Kadeya, believes that at the beginning consumers might find the bottle attractive and take it home. However over time they will realise it’s a burden to keep and return it back to the designated station.

Through their data gathering Kadeya provides insights into both the impact of eliminating single use plastic to the planet as well as hydration for the wellbeing of the employees.

Government | ReLondon takes an active role to stimulate circular economy

In the UK the local government has gone a step further. London has created ReLondon which is a platform for Circular Economy initiatives - a partnership of the Mayor of London and the London boroughs to improve waste, resource management, and transform the city into a leading low carbon circular economy. Working with businesses and local communities, they are tackling a number of problems including food waste, here are the success stories:

Toast Brewing funded by the mayor of London’s green new deal | successful pilot for making beers from leftover bread crumbs that can be used as input for brewers, developing partnership with international brewers

Allplants looking to understand their environmental impact |Allplants provide plant based meals for busy people. ReLondon business transformation team provided insights they need to understand and communicate their environmental impact

Conclusion:

The landscape of the food and beverage industry is mostly led by activism and community effort, there are not many big players yet that can prove a scalable business model. In my view there is work to be done in educating consumers about how they can contribute in reducing waste and choosing proteins with less impact. I would like to see governments play an active role in this, for example reinforcing taxation on red meat.

Well done on making it this far and thank you for reading the second part of my article. Find this article interesting? Please share it as widely as possible.

If you work in one of the brands featured or have more use cases like this, contact me and share your thoughts.

If you're a new business exploring circular models or a corporation building a team to pilot circular models, let's connect—I'd love to help you get started.

WHAT’S NEXT?

In the next chapter, I'll present a practical guide to creating a circular business model that applies equally to both corporations and startups. This guide is based on my own experience with building several circular pilots and extensive research into profitable circular business models that deliver clear value to consumers.

I love back market!! such a great sustainable option