Welcome to Climate Drift - the place where we dive into climate solutions and help you find your role in the race to net zero.

If you haven’t subscribed, join here:

Hey there! 👋

Skander here.

If you’ve been following Climate Drift for a while, you know we talk a lot about FOAKs, first-of-a-kind climate projects. Because let’s be honest: it’s one thing to pitch a bold decarbonization vision, it’s another to actually build the first plant, facility, or system that makes it real.

FOAK is where things stop being theoretical. It’s where tech, capital, and execution collide and where a lot of climate companies run out of road.

We're trying to cross this valley in the middle of a geopolitical storm. Policy volatility, inflation pressures, grid uncertainty: the stakes are rising, and the margin for error is shrinking.

Enter Nik, driftie of our latest cohort and a seasoned industrial exec who spent two decades with leading multinationals and pivoted with his team during the pandemic to blitz-scale COVID PCR test manufacturing.

In this piece, Nik dives into:

🧭 Why FOAK is the toughest stretch for climate tech and why we need more ventures to get through it.

🏗️ The real blockers: capital gaps, team readiness, permitting hell, and the wrong kind of vibes.

💡 A roadmap for founders, funders, and corporates to build “Fit-for-FOAK” projects that actually survive and scale.

This is your FOAK field guide.

🌊 Let’s dive in!

P.S. Sorry for going dark the past few weeks. We have been busy:

Working closely with our latest cohort (this challenge is the first to come out of it)

Launched a free email crash course on the current state of climate solutions. Over 500 people have joined already.

Building out our community, with weekly deep dives and meetings. We are opening application now for our readers.

And yes, there’s more in the pipeline. You’ll see it soon.

More on all of this in the coming weeks. Consider this your preview.

🚀 Want to make an impact?

Our next accelerator cohort kicks off soon, and applications are still open, though spots are limited. If you’re ready to drive climate impact, now’s the time to apply:

But first, who is Nik?

Nik, is concluding a 20+ year international corporate executive career with major industrial multinationals, where he held roles in both Finance and General Management as a VP. He is now transitioning into the climate sector for the next phase of his career.

During the pandemic, Nik was involved in blitz-scaling COVID PCR test production, and he is eager to apply his experience in helping to flatten the COVID curve to the challenge of flattening the Keeling Curve.

To start this journey, alongside his Board role at Envergia in the EV battery recycling space, Nik plans to help corporations shape strategies for an efficient net-zero transition through FP&A for credible Corporate Transition Plans. He also aims to support Climate Tech ventures with their strategic readiness for the FOAK phase and beyond.

The FOAK Field Guide

“Welcome” to the hardest phase of Industrial Climate-Tech:

The first-of-a-kind (FOAK) stage - where the rubber hits the road in the start-up ecosystem.

The Goal: Prevent the current Climate Drift from turning into a full-blown Climate Disaster (aka avoid that Marco and Skander have to ever rename this site…)

As of 2025, the climate emergency continues to pose a catastrophic risk on a global scale. This gives us 3 choices:

1) Drive mitigation & carbon removal solutions at an unprecedented speed & scale…

2) Take on even more planetary risk in the form of geoengineering to “buy us more time”…

3) Hope for the best and adapt – maybe possible for some rich cities / populations but only while leaving a wide swath of the world exposed and making some regions potentially uninhabitable. With enough time under this scenario, Mars may indeed eventually look like an attractive option…

In 2015, we decided on Choice #1. Nearly all countries of the world committed to keep warming well below 2C. However, the 1.5C ambition has already become unrealistic as things stand without significant overshoot.

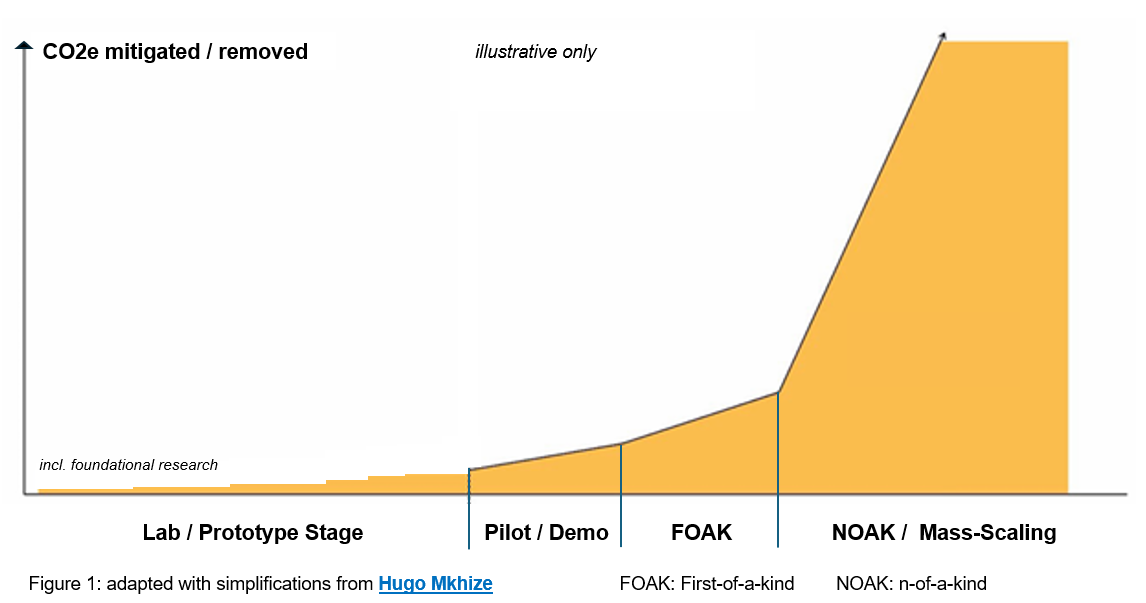

We are behind and need - more than ever - a rapid decline in greenhouse gas emissions. We will need many Climate-Tech companies reaching the “n of a kind” (NOAK) stage. NOAK refers to scaling and rolling out multiple (n) commercial installations based on a repeatable “first-of-a-kind” (FOAK) installation or offering. NOAKs must be impactful, profitable, and capable of growing.

Only at the NOAK stage will a solution or company begin to have a significant impact on greenhouse gas emissions, as Figure 1 aims to illustrate:

However, just before we reach NOAK - the promised land of impact, revenue & profits - there is the FOAK Valley…

Plenty of things can go wrong at the NOAK stage and before. But it is often the first-of-a-kind (FOAK) “Valley of Death” that is recognized as the most challenging part of the journey.

During the first-of-a-kind (FOAK) phase a Climate-Tech start-up must demonstrate its first full-scale commercial facility, product, process or business model. It must prove its viability on a larger, industrialized commercial scale. Think of a Climate-Tech venture’s first sustainable aviation fuel plant for example.

A lot of risk will have been mitigated before the FOAK stage in the prototype and pilot / demonstrator phase. Or else, we are either not at the FOAK stage yet or it is simply a “start-up suicide by FOAK”. However, scaling from pilot/demo to commercial scale for the first time always screams risk. The keyword here is “first”. It’s simple: first means risk.

Regardless, many ventures will need to successfully and quickly cross the FOAK valley in the coming years to drive our urgent transition to Net Zero.

4 key elements that make the FOAK valley so difficult for a lot of Climate-Tech start-ups include:

1) Industrial Climate-Tech FOAK projects fall into a chasm of Capital Deployment and Funding. FOAK projects are often too big for VC Funds (equity). Depending on the type, they require 20+, 50+, 100+ million USD of CAPEX and often more. At the same time, they do not yet fit the risk-reward profile of Project Finance (debt), due to the inherent industrialization risk of a “F”OAK. Project Finance can write very large checks for infrastructure but a core tenant is not to take on any binary technology risk. A pro tip is to not even dare to call it “FOAK” when talking to Project Finance… ”Emerging infrastructure based on proven, scalable, modular design with off-the-shelf components” would sound better (if true), but even that is still not perfect due to the word “emerging”. That even the fundamental language is so different between VCs and Project Finance creates this difficult, inherent “funding gap”.

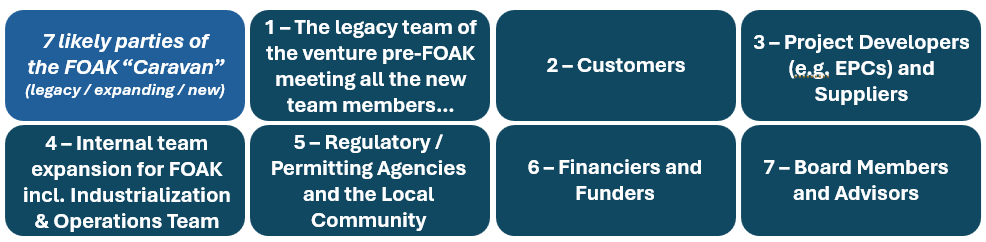

2) Further, before a venture enters the FOAK valley a significant Team and Competency scale-up will be required. For example, technology development teams are not industrializers / project developers and vice versa. Each has different cultures (think for example around industrial safety) and competencies (think lab coats vs steel-tip-reinforced work boots). The FOAK stage always means bringing in new competencies and a broader team. This includes building a broad partnership especially with external stakeholders, like suppliers and customers - all needing to be aligned, equipped with the right incentives and then jointly venturing out into the valley as a group. Yes, a bit like a “caravan venturing through a large desert valley”… but one that goes through a territory for the first time for this exact technology, process, business model or market niche.

3) Industrialization is hard for any novel technology combination / process. Even if you have the best internal/external team and lots of capital, you must expect to enter “manufacturing hell”. Even if 99% of all components and processes work great, it is that unknowable 1% that can trip you up, make you scramble for short-, mid- and long term solutions and prolong the journey. This is also the main reason why we even need to complete a good, solid FOAK before entering the NOAK phase. FOAK needs to make the venture “boring” (read “bankable”) not just from a technology perspective but also from a process, management and manufacturing perspective. If that is not fully taken care of, the NOAK stage may unravel completely - as the tragic case of Northvolt has demonstrated. At the same time Northvolt is an unfortunate case study on how a FOAK plant can go wrong. “FOAK before you NOAK” should be self-evident. It is extremely high risk to build 6 gigafactories before a stable FOAK plant is established as in the case of Northvolt.

4) Last but not least, the Start-up and Venture playbook we have used to especially scale software in recent decades is inadequate for Climate-Tech. “Hard” Climate-Tech at the FOAK stage is a large-scale, capital intensive industrial development project. That poses a significant problem because for example:

a. For FOAK projects the cultural Silicon Valley mantra of “fail fast and break things” is a cultural mismatch with Project Developers.

b. Worse, while software companies can launch an MVP (minimal viable product) to generate first solid cash flows and then rapidly iterate this will not be possible for Climate-Techs in the FOAK Valley. Where a software venture celebrates their MVP launch, the Climate-Tech venture stares down into the daunting FOAK Valley…

c. Finally, bringing a “fake it until you make it” mindset into the FOAK valley will simply result in potentially hundreds of millions of USD value destruction, next to lots of old fashion lawsuits. An “unbelievable” case study here comes from within the diagnostic space with the implosion of Theranos.

Also, areas like Pharma and Biotechnology provide imperfect proxies in this regard. Pharma and Biotechs enjoy a by-now-mature system of established “consolidators”. Those are major companies that integrate successful startups with promising, strong Intellectual Property (IP) under their wing through corporate M&A or licensing deals to take on late-stage clinical trials and/or commercialization. Given the absence of large, established “consolidators” in the overall, emerging and fragmented Climate-Tech space, such established templates and playbooks do not yet readily exist to help with FOAK industrialization projects.

So then “if we have to” (...or else) - how can we best get through this…?

For all key dimensions the main question is:

When is it “safe enough” for the whole caravan of team members and stakeholders to go through the FOAK valley? And what can we do to increase survivability?

… before we venture into the FOAK valley? (Part A)

… when we are inside the FOAK valley? (Part B)

… when we transition out of the FOAK valley to enter NOAK territory? (Part C)

These 3 Parts form a practical Roadmap and structure that we will walk through below.

Bottom Line: What risks need to be minimized - and how - so that financial and human “resources” can be attracted and once attracted not “wasted through poor fundamentals”? Please let us never, ever underestimate the opportunity costs of a poorly executed FOAK for the overall system as we aim to get to Net Zero at speed & scale …

Part A: 3 Crucial Things before anyone even sets one foot into that valley… (hint: this is the longest part of the deep dive for a reason)

1) Are the numbers on the “TRL” & “ARL” scales right? Uh - great, more acronyms…

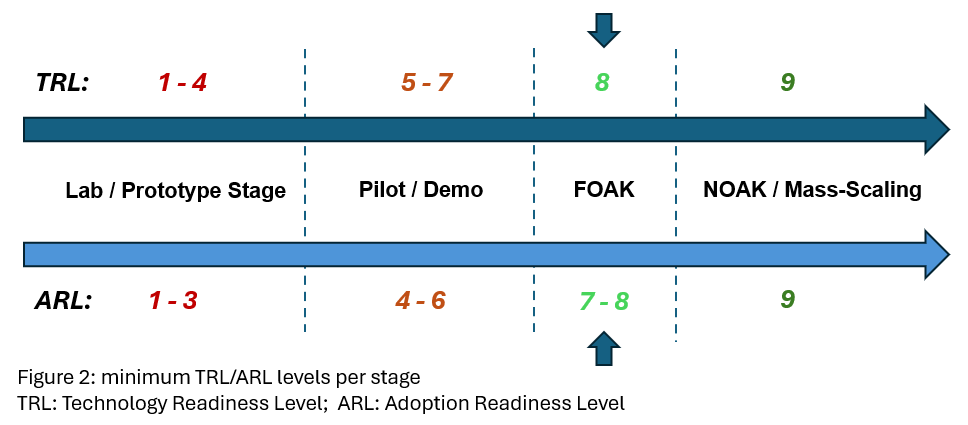

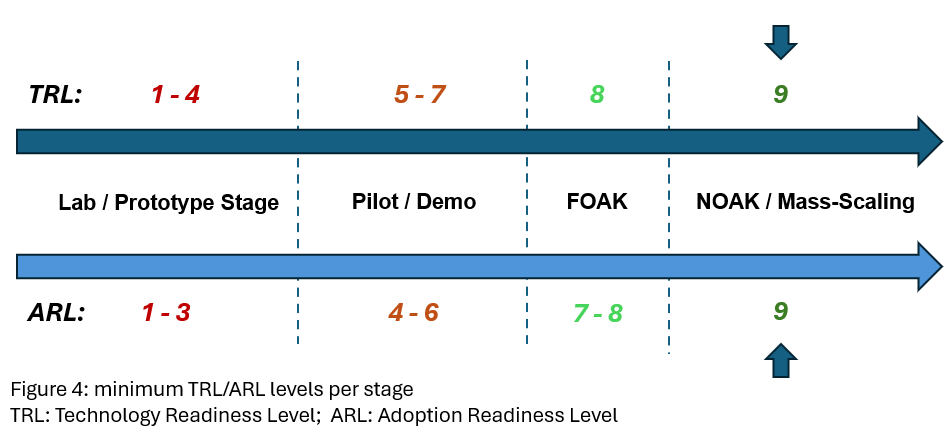

Ok - I am a numbers (and acronyms) guy by upbringing. Hence I am biased… but the first thing that a venture should discuss in their regular board meetings is the progress on the Technology Readiness Level (TRL) - and on the Adoption Readiness Level (ARL) Scale. A Final Investment Decision (FID) for a FOAK should only be taken if the required minimum TRL and ARL have been reached. The evaluation hereby needs to be based on solid data. For example based on a professional, solid techno-economic analysis (TEA) and on a real, existing, representative pilot or demonstrator site, one that has run sufficient hours and can be visited. Ideally the pilot / demonstrator consists of a modular design that allows scaling the proven system to FOAK scale. Using off-the-shelf components that undergo their own quality control likewise helps. Figure 2 aims to illustrate the recommended TRL and ARL ratings to commence a FOAK:

If the right TRL and ARL have been reached and correctly assessed, it will help to mitigate the risk of overlooking fundamental flaws and missing elements in the readiness of the venture to go forward - even if all stakeholders are very excited (groupthink can affect all groups). Bonus Point: building as much IP as possible before FOAK may help with the risk that there is little substance to collateralize at this stage of the venture, adversely affecting the financing stack.

2) Hey there – let’s meet all the new team members:

The tech dev team / founding team will need to do the hard work to create an aligned and effective “Fit-for-FOAK” Team & Plan with new internal and external members.

Climate-Tech FOAKs are a multi-year endeavor and cannot be transactional. Careful selection and successful alignment of all “Fit-for-FOAK” parties into “One Purpose-Driven Team” are essential to drive down risk. The “5 Cs of the Caravan” hereby are: Collaboration, Consensus, Conviction, Commitment and, well, Contracts…

In order to maximize the chances of success, deliberate, detailed business planning together with all stakeholders that make up the FOAK “caravan” is crucial. This is especially critical as an input for a very solid project and finance plan to optimize the funding required and determine the associated financial- and time-buffers based on solid scenario and sensitivity analysis. Projects that are on budget, on time and on benefits are the absolute exception. The antidote is putting enormous care and effort into the right kind of planning to ensure that delivery is smooth and swift. Project task parallelization may be an adequate tool to accelerate the project timeline. However this often comes with additional risk and the risk-reward equation should be carefully deliberated together with all other variables.

All internal and external team members and partners need to have the conviction that there will be profitable NOAKs after the difficult FOAK phase that they can participate in. Because the terms, conditions and profitability for a FOAK are likely less favorable vs. a NOAK. Participating in the NOAK phase can even out the terms and costs.

The exact composition of the required parties will vary greatly with the documented and validated specific features of the project plan iterations. The key features to deliberate include the site, resource needs, required permits, technology, team, capital and offtakes.

The resulting list of required parties will likely include:

Customers

A FOAK project should aim to have solid “offtake” agreements for most or even all of the FOAK output in place before taking the final investment decision. The offtake terms with one or multiple creditworthy customers / corporate partners will ideally be flexible & strategic. The finance stack can then be deployed with a lower risk profile against these. Offtakes serve a function not dissimilar to long term power purchase agreements in the energy space, providing security to financing. Offtake pricing is hereby key. A FOAK is intended to be profitable, while showing that pricing and volume can realistically work also in the later NOAK phase. For a case study on offtakes in the cement space, please see the deep dive by Tessa Peerless on Climate Drift.

But why would corporations want to “partner”? First, these partnerships are already getting more common, consider for example the partnership between Holcim and Sublime Systems for offtakes plus equity investment. However, in my view the broad answer will lie ever more in the (slowly) emerging higher-quality and higher-quantity Corporate Transition Plans (CTPs). New policy and regulations, emerging from governments like the European Union (ESRS E1) or bodies like SBTi, CDP and now ISO that companies may sign onto in their journey to Net Zero drive their adoption. CTPs are where the “rubber hits the road” in the Corporate ecosystem. This field clearly is still emerging and has many of its own issues. It will become ever more clear in the coming years that corporations hereby have a strong technological dependence on the Climate-Tech Venture ecosystem. The choice may likely be for many corporations to either lose their e.g. SBTi rating or invest / pay a selective green premium and help Climate-Tech run down the cost curve to reduce such green premiums over time. And yes, dependent on the size of the green premium, the financial health and many other factors of a given company, some will choose to drop their rating or not aim for one. However, others will do what is right for the planet and people in addition to profit. Those will act together with the suppliers in their respective value chain and their own end-customers who may support by accepting a slight green premium themselves. The full range will be on display in the coming decade between the early adopters, the middle, the late adopters and the resistors in all corporate verticals. But on the positive side for example we already see some leading corporations supporting durable, high quality (read expensive) Carbon Dioxide Removal (CDR) in the voluntary market. A case in point, because CDR in effect constitutes a “pure voluntary green premium” onto regular business. There is no additional business benefit from buying CDR, like moving goods around through sustainable aviation fuels. The goal is purely to achieve net zero through sending cash to CDRs. And yes, a lot more needs to be done as for example the speed & scale tracker will quickly point out.

Further, investments beyond the direct / current supply chain are likewise part of this desired corporate response. This may increase opportunities for corporate investments into FOAK ventures. Those could act like “patient” catalytic capital or be blended with offtakes. This could also take the form of corporations using their stronger balance sheets, assets, resources and capabilities to drive down risk and financing costs. A good but unfortunately tragic case study is again well-funded Northvolt where Volkswagen was a strong backer.

I do not wish to be over-optimistic in light of the problems noted above - from green-washing and green-wishing to the undesirability of inflationary pressures on end-customer prices when invoking the “green premium”. However, the growing momentum within the corporate sector should not be underestimated or dismissed in the critical decade ahead. We will have to see and carefully monitor how this space develops. And write another deep dive…

If done right, this will help to mitigate risk around: market-product fit risk and financing risk

Project Developers and Suppliers

The FOAK project will likely require one or more EPC (Engineering, Procurement & Construction) partners. Experience is key - EPCs can make or break the project through the quality of e.g. their front-end loading planning & preparation. One of the biggest risks for a FOAK are prohibitive cost overruns and project delays. Accordingly, EPC tasks should not be fully abdicated by the internal team - significant control over the EPC workstream should be maintained through adequate capabilities of the internal industrialization team. In the case of multiple smaller and specialized EPC partners, the project integration should likewise be done in-house. Selecting a mission-driven lead EPC partner - one that does not see the FOAK as just another customer - can be highly beneficial. Setting up a partnership also for the NOAK phase, if possible, can allow the cost amortisation of the EPCs expenses over multiple, replicable projects.

Depending on the nature of the FOAK, many other suppliers will be required - from smaller manufacturing equipment to production feedstock. Gaining contractual certainty over input prices may be a vital de-risking tool. Similar to corporate offtakers, the possibility of deeper partnerships and support, including financing from the suppliers side should be explored.

If done right, this will help to mitigate risk around: industrialization / project development, financial risk on project cost overruns and project delays.

Internal FOAK Team expansion including the Industrialization and Operating team:

The internal team will likewise need to be expanded through experienced individuals with a strong track record and the right, mission-driven attitude who are “happy to run” through manufacturing hell. Sounds impossible but what blitz-scaling COVID PCR test manufacturing during the COVID pandemic proved to me is the power of an urgent, external, mission-driven situation. I believe the same applies for our urgent transition to Net Zero in the eyes of many talented individuals who will take up the challenge given the opportunity within a promising FOAK situation. Depending on the venture, a Chief Operating Officer, a Manufacturing team, Engineering for Industrialization & cost-down as well as Maintenance next to Quality, Regulatory/EHS, Commercial and Finance/Admin are all (potentially new) functions where new team members are likely required. If internal full time roles are not yet right for the venture then supplementing selectively with contractors and/or fractional roles may be advisable. Next to functional capabilities, experience and being strongly mission-driven, it is vital to attract people that can drive “system repeatability” in the NOAK rollout phase. This includes teaching skills and availability to travel during the NOAK phase. In addition to significantly expanding the venture’s capabilities, this will change its culture. Nurturing a positive and high-performance team culture and avoiding internal silos building up is of primary importance at this crucial, expansive stage.

Another COVID PCR-Test blitz-scaling lesson: The relentless focus of the team needs to be on the end-to-end optimization between the engineering function of the external original-equipment-manufacturers (furnishing the production equipment), the inhouse Industrialization engineering (machine settings and process interface to operators) and the process optimization by operators and maintenance. Only if that critical chain works well under pressure can the scale-up and industrialization timeline be effectively compressed. The crucial interface between the external and internal engineering is also highlighted as a main reason for the difficulties at Northvolt in the Catalyst podcast episode on the Northvolt case.

A word of caution: The success of scale-up depends heavily on the preceding pilot and demo phase (the “second valley”) and a modular, scalable design to ensure that the technology can indeed be scaled up. Any remaining small technological flaw may become a big issue if scaled up by a further 10x to 100x. Some will be fixable by industrialization but fundamental flaws may set the venture back by years, likely making it late compared to competing technologies or ventures and/or leading to fatal cost overruns.

If done right, this will help to mitigate risk around: industrialization, organizational culture and -performance during output scaling as well as current and future cost assumptions / future cost-down curve behavior.

Regulatory / Permitting Agencies and the local community for the (potentially) new site to fulfill all permission-to-operate requirements:

This step can take a long time and result in costly delays if not handled correctly and early enough - with the right internal and external capability and capacity. At the same time local governments, agencies and the community can also be an important source of funding through grants and incentives, as well as ensuring that permits are processed quickly and that the local labor pool is excited about the new venture. The strength of local support may become a key consideration in determining the location of the FOAK. On the other hand, it would obviously be interesting or even best if the regulatory environment does not have to change at the FOAK stage. This could be the case when local support is strong and the FOAK scale commercial plant can be built on the same site or in the same community / jurisdiction as the smaller pilot / demo plant. However, in this case it will be the NOAK phase that will need to master any new regulatory / permitting complexity. Ultimately, either the FOAK or the NOAK phase must master the ability to effectively explain the venture to new regulators in order to secure all necessary permits - a capability that should not be underestimated and built up accordingly.

If done right, this will help to mitigate risk around: permitting, policy, zoning, regulations and potentially provide favorable community engagement, local grants and incentives to support the financing stack.

Now onto the big one… Financing…

All of the above parties, if individually “Fit-for-FOAK” and aligned amongst each other, can together significantly drive down the risk of the venture. This should be a strong prerequisite for the final discussion with the new Financiers / Funders around the FOAK financing stack. If risks are minimized through the group, the risk-reward equation will become more favorable for the capital stack, enhancing fundability compared to a FOAK with higher, unmitigated risks (see Key 11 & 12 from Catalyst). FOAKs will still face the inherent funding gap between VC funds and Infrastructure Funds as mentioned earlier. This will likely mean a “funding smoothie” is required, involving multiple financing vehicles. This will be specific to each FOAK and may include funds from a variety of traditional sources, including federal grants but also likely from non-traditional sources like tax-credit equity schemes or philanthropic catalytic capital. If a credible and renowned “lead” investor can be found early as part of the Fit-for-FOAK stakeholder group, it can have positive halo effects and bring other funders along later.

Given the capital stack’s wide variety of options and intricacies, I recommend reading the Climate Drift deep dives by Jarek Dmowsk: The capital stack for scaling climate infrastructure, and by Mairi Robertson: How has the climate tech capital stack evolved?

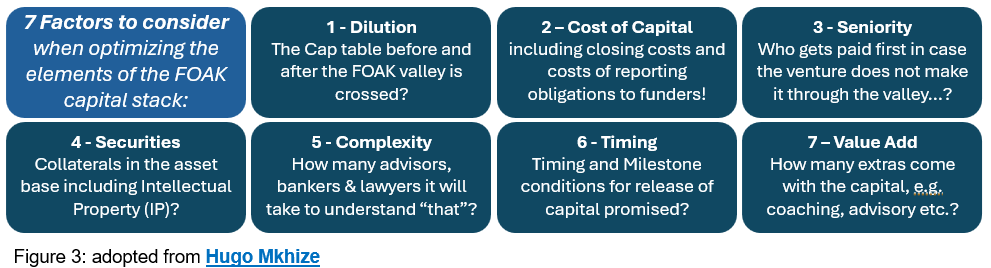

Each funding source has unique advantages and disadvantages, and the founder team needs to optimize the finance stack along 7 key factors as outlined in Figure 3:

If done right, this will help to mitigate risk around: financial funding and -buffers while retaining a cap table that still significantly incentivizes the founding team.

Last, but not least - Board Members and Advisors:

As new funders join the FOAK stage through the hand-crafted capital stack, new board members and advisors will likely come on board.This is a great chance to further add deep experience, complementary skills and capabilities to the venture, as well as network connections to the wider ecosystem and key personalities who can drive ongoing alignment within the wider stakeholder community.

If done right, this will help to mitigate risk around: a wide variety of risk factors as well as ideally keeping an eye out strategically towards NOAK scaling readiness in the middle of the high-pressure FOAK phase.

As you build out your “FOAK caravan”, I strongly recommend: Do not easily accept caravan members who cannot be fully aligned or are not “Fit-for-FOAK”. If just one internal or external function fails to perform-at-peak and with the required “sense of mission for the whole”, the chances of timely success will significantly diminish. In a FOAK situation it is not enough if 90% of the areas/functions are successful. All must be successful to march through the valley together, with the right speed to scale quickly.

3) Sounds daunting…? The key is to focus on FOAK readiness starting no later than the Prototype / Series A stage - “always-think-FOAK”

“Always-think-FOAK” should include at least the following 3 critical dimensions:

1) Keeping your cap table (the company ownership structure) clean and optimized in the run up to FOAK. This is vital so that the founding team stays incentivized and the venture fundable. Problems could include e.g. too much dilution of the founders equity combined with too many partners / advisors with small / tiny ownership fractions early on. Once a cap table is broken, fixing it - on top of all the other FOAK challenges - might be impossible. Another important related task is to determine the optimal entity structure for the FOAK project, often for example a subsidiary through a special purpose vehicle (i.e. a separate FOAK Project Company).

2) Ensure that you figured out very early what it is that you are really selling: your underlying value proposition and the shape of delivery of your product-market fit. Ask - are you a developer, an OEM (original equipment manufacturer) or a licensor? This will significantly influence the FOAK project’s structure - from funding needs to required partners. A great way to scope this out within the founding team is to write the press release including frequently asked questions for your venture-at-scale early in the process - aka “working backwards”.

3) Always scout for potential “fit-for-FOAK” partners in early stages that may later form part of the “FOAK caravan”, including later financing partners. It takes time to find the right partners and it needs time to build and develop the right relationships. It is not easy to drive this in addition to all that is happening at the lab / prototype and pilot / demo stage but a 3-pronged cost-efficient approach to enable this may include:

Engage at least a fractional “Chief-FOAK-preparedness-Officer” early-on to work in parallel with the tech development team. This should be an empowered, senior individual with enough agency, who also brings the ability to discuss early commercial terms with potential relevant corporations around offtakes and partnerships. Driving the deliberate, detailed and iterative project planning from the first minute onward is likewise a key task for this role.

Create and maintain an FOAK-focused advisory group that meets regularly (i.e. quarterly) and includes at least one member with a strong and relevant background in the following: engineering/industrialization, operations, project contracting and EPC, an industry user / market expert and ideally a relevant government entity expert. Such a 5+ member advisory group can think through the key FOAK dimensions early, help shape the iterative project plan, as well as helping with the search of “fit-for-FOAK” parties and partners.

In addition, a new group of specialized players is now emerging in the FOAK ecosystem that offer specialized support also and especially beyond “just” financing and funding. This group includes for example organizations like the Emergent Infra Team around Tim Woodcock, Node Climate/V1 Climate Solutions (Deanna Zhang), Mark1 (Julian Ryba-White) or Precursor (David Yeh).

Ok - after all this long but vital preparation…

… if you think the FOAK caravan is now in place: Look to your left. Look to your right. Then look down at your project plan. Would you dare to enter the FOAK valley with this plan and this “caravan of parties”? If the risks are minimized in the best possible way and the internal / external parties aligned - and I recommend only then - ok, go ahead …sign off the Final Investment Decision and let’s go…!

However, if there is no way to build a strong, aligned “caravan” together with a good plan, because the fundamentals of the FOAK are too weak then it might be better to fold at this stage. Not all ventures will succeed but we do need all the entrepreneurial experimentation and drive in our fight against the climate disaster. A FOAK that does not go forward due to critical elements missing (like adequate funding) or not quite working out technologically is not a failure. It is a vital experiment and we will owe a great debt to all teams that reached the pilot / demo stage. Their technology and contribution might still live on - whether through the underlying IP or team members joining another venture.

Part B - Inside the Valley: It’s always either too hot or too cold in Death Valley… it is never comfortable…

Let’s briefly look at 4 critical considerations for the actual time inside the FOAK valley after the final-investment-decision (FID) has been taken:

The real currency is time in this very critical & uncomfortable phase: Get in, get through, get out - fast & successful.

This makes the case for having the best, mission-driven execution-project management ever seen on Planet Earth for your FOAK. The FOAK preparation phase - if done right - will have delivered an aligned, detailed and deliberate project plan for execution. Fantastic project management is essential to execute and navigate the unique challenges of FOAK projects. The goal is to ensure that the wider project team resources are optimally allocated, potential risks, delays and bottlenecks are anticipated and mitigated (ideally based on regular pre-mortems), and buffers are in the right places so that the overall project timeline remains on track. For more on the many ins and outs of project management it is recommended to start with “How Big Things Get Done” by Flyvbjerg / Gardner. Of course it is true and clear that all functions must perform at their absolute peak during FOAK, but it is upon mission-driven project planning & management to successfully navigate the caravan through the valley…

Exhibit 1 of why time is the real currency in FOAK: The Cash pool will burn down fast - like water evaporating in the desert.

Excellent cash management via a small but strong finance function is key. Adequate financial buffers, -controls as well as cash burn down charts and granular forecasting, reviewed in-depth weekly, should all be in place. However, while cash and financial controls are vital, remember, the main currency always remains time. The case study of Via Separations demonstrates that expenses, cash-burn-rate and time need to always be seen together. Via Separations took on some extra costs next to scaling risk for example to avoid having to wait several months extra through the Canadian winter to start their FOAK construction. Even if direct project activity/spend is low (due to waiting), your overhead will be causing cash-burn. Further, the longer projects drag on, the later benefits kick in and the more they are exposed to additional “expensive” adverse events like say policy changes. Last but not least, financiers and funders will expect a timely return. That applies even if it is “patient” catalytic capital through philanthropic funders - because there are other projects in the queue that also need some of that sweet funding… give it back asap to pay it forward…!

Exhibit 2 of why time is the real currency in FOAK: Your offtakes will need to be delivered to your waiting, real customers…!

Remember all those offtakes, ideally selling out all of our FOAK capacity up-front? Well, this is no longer a lab science project - FOAK is the first commercial scale entity and should, will and must feel “real customer pressure to deliver”. Next to the cash-burn-rate chart, delivering a real product to real customers on time, at costs and at quality will focus the minds and drive time pressure. You must expect to enter “manufacturing hell”, even under the best of circumstances. What could happen when offtakes are not delivered? Well… back again to the tragic case of Northvolt where BMW pulled out when expectations were not met, causing a first visible sign of trouble. Always remember: Corporates have time-bound targets and want to progress to Net Zero in line with their Corporate Transition Plans… and there are organizations and systems in place that (rightfully) hold corporations accountable on those.

Along the way maintain transparency for all internal and external parties and a strong mission-focused cohesion to enable finding solutions together:

At risk of over-repeating: even in a highly successful FOAK some things will go wrong, and delays will consume time buffers. However, if all parties have been pre-aligned and are cohesive, incentivized and mission-driven, then all stakeholders will have something important to lose if the FOAK is unsuccessful. Maintaining this mission-driven team cohesion, with quick escalations and transparency about the remaining risks, challenges and the overall real progress is key. There can be no silos & fake-it-until-you-make-it approaches in industrial Climate-Tech FOAK projects. I believe transparency that maintains and further builds trust is the price to pay for the demand that only “Fit-for-FOAK” parties come on board for the journey. And only transparency can enable a joint approach for finding solutions. Of course, tempers will flare, and discussions will be heated, because it is always either too hot or too cold in Death Valley, CA. Do not underestimate the psychological and human management dimension as the caravan ventures through the valley… value the team- and alliance-builders and -maintainers you have with you on the journey. A joint meditative reading of “Conscious Business” by Fred Kofman in combination with “How Big Things Get Done” by Flyvbjerg/Gardner might be a good place to start…

Part C - Out of the FOAK Valley: we made it through… right…?

Did we make it through the FOAK phase - are we now ready to enter the NOAK phase…?

Great question - well, depends if the numbers check out: Is the Technology- and Adoption Readiness Level (TRL & ARL) now squarely “category 9”? If yes, it`s NOAK time - but only then…

There are 3 Key Outcomes to absolutely lock-down in combination with the TRL and ARL numbers reaching a stellar 9.

All 3 should be clearly achieved based on clear proof points and documentation:

Key Outcome 1: A profitability-proven FOAK must now exist that can scale towards NOAK. Based on:

a) The willingness to pay for the offering by future customers also beyond “just” early adopters/supporters.

b) Dependable, favorable cost curve effects going forward, including the ability of future NOAKs to cover the financing and corporate overhead costs while expanding the profit margins each year. When modelling NOAK phase profitability scenarios it is likewise required to pressure test market price assumptions and -developments that will determine future revenue levels.

c) It must be ensured that the profitability expectations are still backed by a competitive advantage that is durable in the market and will not be rapidly substituted by better technology offers. Another feature on the brink of the NOAK stage for Climate-Tech is often the dependence on policy and political forces that can induce risk like e.g. adversely changing subsidies or evaporating tax-credit regulations that all just created an illusion of profitability. It is critical to understand to what degree the venture is now still dependent on green premiums and favorable policy and how realistic and durable those might be.

Key Outcome 2: An end-to-end process-proven FOAK must now exist that can scale towards NOAK.

Based on:

a) The whole end-to-end value-delivery-chain must have successfully completed the industrialization challenge. This also includes industrial elements like successful initial optimization through continuous improvement tools and the built-up of an environmental, health and safety (EHS) culture. All this needs to be evidenced by a significant number of hours of stable system operations and be backed up by solid performance guard-banding data. “Manufacturing Hell” and undue variability needs to be a thing of the past.

b) The FOAK team has created the ability to systematically set-up and train the team of the second- and third-of-a-kind installation and beyond. This needs to be backed up by solid, written process and systems documentation across the whole value chain and all functions. Experienced FOAK team members will need to (at least partially) hand over the FOAK installation to new operators and be excited, capable and motivated to teach and roll out the system. This can include international expansion with its added complexity around different operating cultures.

Key Outcome 3: A risk-mitigated FOAK must now exist with a strong business plan and governance that can attract Project Financing for future NOAK scaling, achieve an exit or licence out “the system”. The venture must now be risk mitigated in the eyes of Project Finance / Infrastructure Finance providers, also on the commercial side. This is the “simple” test if the funding-gap chasm described above has been crossed. Having achieved project-finance-grade through an acceptable, very low risk profile with the ability to achieve internal-rate-of-return (IRR) expectations, the venture should now be able to attract large sums of low-capital-cost debt through major banking institutions. This may include tapping pension funds and other major capital sources through the banking system.

The choices for scaling in the NOAK phase include fully self-scaling the system while staying private as a Development Company; exiting via an IPO or a M&A sale with only a few NOAK installations or setting up partnership structures for rapid expansion for example via Joint Ventures (JVs) and/or granting licenses for the NOAKs. Depending on the type of Climate-Tech venture this can include geographic expansion with its added challenges of regulatory and permitting in different jurisdictions. Hence, the NOAK phase has its own unique set of challenges and plenty of things can go awry in this “major-company” phase and Valley Number 4… but it is also the time when the technology of the venture can begin to impact the world’s rising CO2e levels – and contribute to bending e.g. the Keeling Curve, together with all the other, many solutions we will need to further deploy.

For specific additional insights around 11 different case studies including Fervo Energy, Monolith, Rondo, Via Separations, LanzaTech, Solugen and Stegra (formerly H2 Green Steel), please see the following 2 reports:

Remember - FOAK is not the goal, it is the key hurdle to jump over. It is where the rubber hits the road for a Climate-Tech venture – and once you are through:

All the best and good luck in NOAK territory…!

Interested in learning more or discussing strategic readiness and execution for the FOAK phase? Connect with me on LinkedIn – I'd be delighted to receive your connect request.

I'm always happy to jump on a call to explore how I can assist you, whether you are:

A founder: e.g. Seeking a trusted advisor to structure and set up your FOAK advisory board, or to help navigate the FOAK challenges for your venture.

A funder/financier: e.g. Supporting a promising start-up in your portfolio or prospect list that needs to sharpen its business and financial planning for the next funding round.

Part of a corporate team: e.g. Looking for the perfect fit in the start-up ecosystem to support your decarbonization journey towards Net Zero in line with your Corporate Transition Plan.

We need to get a lot of great NOAKs up and running to make a dent in the Keeling Curve – let’s explore opportunities to collaborate on this mission!

A great post about a critical area, FOAK is tough, and necessary. I'm really glad that not only was the people element not ignored as it often is, but it was front and central, from the execution team required, to the benefit and need of Board members and advisors. Nothing good happens without good people (talent).